1 in 5 charities received a grant from a donor advised fund in 2021, and 7 other major findings from a new landscape report

Why It Matters

Gifts from affluent donors comprise a growing share of the total donations flowing to Canadian charities; and an increasing share of these wealthy donors are choosing to give through donor advised funds. This sea change has implications for fundraisers.

Over the last couple of years, Yvonne Harding has seen a new type of donation flow into her charity’s account, and a new report shows she’s not alone.

Harding is the one-woman fundraising team of the Assaulted Women’s Helpline, a charity that offers 24/7 telephone crisis counseling for women across Ontario who have experienced emotional, physical or psychological abuse.

Their core funding — over $2 million each year — comes from the provincial government. These funds are essential, Harding says, but they’ve not kept pace with the astronomical growth in demand for their services that’s occurred since the start of the pandemic.

To help bridge the gap, Harding has been writing grant applications, building the organization’s monthly giving program, and strengthening relationships with corporate donors looking for ever-elusive multi-year gifts.

But while she’s been doing all that, she’s seen a modest, but noticeable uptick in a new sort of donation: gifts made through donor advised funds — charitable savings accounts, of sorts, that affluent donors are increasingly establishing to support their giving.

DAF donations have come to the charity from the Toronto Foundation, the AWL’s local community foundation, from the Private Giving Foundation, Toronto-Dominion Bank’s affiliated DAF foundation, and from the Vancouver Foundation.

The gifts have ranged in size from a few hundred dollars to $30,000. “When you get enough of those, it makes a difference,” Harding says.

A new report shows Harding’s organization is one of many, nation-wide that’s newly receiving donations made through donor advised funds.

Far from being a niche tool benefitting just a few big charities, the report, published by the Canadian Association of Gift Planners Foundation and consulting firm KCI, estimated that in 2021, one in five Canadian charities received at least one gift from a DAF.

It’s just one data point among many that shows the dramatic growth in the use of the giving tool by Canada’s affluent — a population whose gifts are forming an increasingly large share of overall donations to the nation’s charities.

In this explainer, we speak with Keith Sjogren, one of the report’s co-authors, and highlight several of the key findings from the research.

Dramatic growth in DAF assets

Across the country, Canadian donors continue to heavily support the sector’s big name charities. World Vision, the Salvation Army, and Plan International, are all among the list of the top 20 charities to receive the most tax-receipted donations in recent years.

But increasingly, affluent Canadians are driving vast funds, too, into DAF foundations — the community foundations, commercially-affiliated DAF foundations, independent foundations, and faith-based foundations offering donor advised funds.

Sjrogen’s report found that in 2021, nearly one in every 10 donated dollars for which a tax receipt was issued was given to one of the country’s 72-odd DAF foundations.

In that same year, eight of the 20 charities to receive the most donations from Canadians were DAF foundations, according to a Future of Good analysis.

Research shows, too, these donations are adding up: At the end of 2021, DAF foundations in Canada collectively held $8.5 billion in charitable assets — up 57 per cent from three years prior.

Further, the report found that both the number of DAFs and the average size of those funds has also grown: At the end of 2021, Canada had more than 20,000 donor advised funds on the books — a 28 per cent increase from three years prior. Further, the average DAF size was $406,000 — an 18 per cent jump from three years prior. (Both figures exclude the DAFs held by Charitable Impact Foundation, a DAF foundation that prioritizes supporting smaller-value DAFs.)

“Every metric you look at points to the fact that these vehicles are getting more and more popular,” Sjogren says.

Donors granting from DAFs at double the DQ rate

In Canada, there is currently no law that requires individual donor advised funds to issue grants on an annual basis. This, and the sheer scale of the assets held in DAF foundations, has led some charity sector advocates to accuse DAF foundations of “hoarding” charitable sector wealth.

Yet, the report co-authored by Sjogren and KCI partner Celeste Bannon Waterman, found that in 2021, the granting rate for Canadian DAF foundations was 9.8 per cent — nearly double the new federal disbursement quota rate of 5 per cent (for charities with over 1 million in assets).

In 2021, the pair’s research also found that DAFs granted $922 million to Canadian charities — a 41 per cent increase from three years prior.

While some of these donations are flowing to large, name-brand charities, Sjogren says a healthy share of funds is also flowing to small and medium-size charities across the country. A Future of Good analysis of the grants made by community and commercial-affiliated DAF foundations found this to be the case, though larger charities netted a disproportionately large share of donations.

Further, a survey conducted with DAF foundations found that half of respondents are taking steps to encourage more money out the door.

Sjogren and Bannon Waterman found that half of Canadian DAF foundations impose a fund-level disbursement quota on fund holders at the CRA-required rate for private foundations. This year, for instance, DAF holders at both BenefAction Foundation and Strategic Charitable Giving Foundation, will need to grant out at least 5 per cent of their fund’s assets.

There’s also a shift afoot with respect to the type of DAF structure being offered by DAF foundations to encourage more granting flexibility.

While “endowed” DAFs — those that allow fundholders only to recommend grants using the interest accumulated on the fund — have historically been the main DAF structure offered; foundations are increasingly also offering “flow through” DAFs, which have a target end-date by which all funds in a DAF must be spent, and “spend down” DAFs, which allow fund holders to recommend grants at any speed with the intention of disbursing the entire fund over time.

In 2021, just 22 per cent of Canadian DAFs were endowed, according to the report — this share of endowed funds was similar when last previously analyzed in 2019.

Still, Sjogren and Bannon Waterman argue that DAF holders have the “capacity to grant at a higher rate,” noting that the granting rate of Canadian DAFs is far lower than in the United Kingdom and United States. In 2021, UK and US DAF holders granted at a rate of 17 per cent and 16 per cent respectively.

They note that if, in 2021, Canadian DAFs had granted at a rate of 15 per cent, an additional $500 million would have flowed to operating charities. This would have brought the 2021 DAF foundation grant total to $1.425 billion (rather than $922 million).

Sjogren says legislation to require a fund-level disbursement quota is one way to boost the rate, but says it isn’t likely in the near future. The government is keen to first collect more information about the DAF marketplace, he says, before imposing new rules.

DAF holders giving a few, large grants, and prioritizing health, religion, and social services

As is the case across the broader charitable sector, Sjogren says, DAF holders tend to have a couple of charities they support each year — not dozens.

Of the DAF foundations who responded to the researcher’s survey, their DAFs issued just 3 grants per year. Among foundations that are affiliated with financial institutions, such as the Aqueduct Foundation, which is affiliated with Scotiabank, the average was lower — with fund holders issuing an average of just two grants per year.

What fundholders lack in number, however, they may make up for in size. The report found that the average individual DAF grant in 2021 was about $10,000. Donors with DAFs at foundations that are affiliated with financial institutions issued the largest grants, with an average size of about $17,000 in 2021.

The research also found that DAF holders offer the most support to charities focused on health, social services and religious causes — with causes in these three categories securing over 70 per cent of all donations, measured by value. (Charities focused on the environment, the arts, and international causes received considerably less support.)

Despite a few exceptions, DAFs are a tool of the very affluent

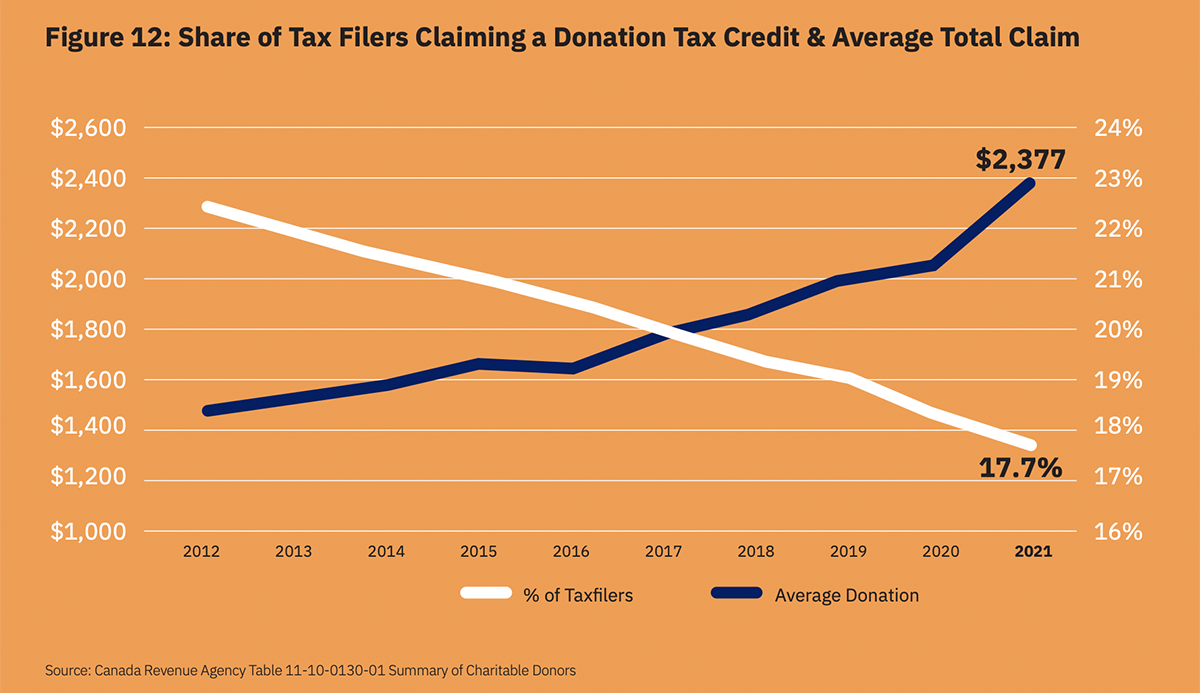

For several years, data from the Canada Revenue Agency, has shown that despite the number of total donors claiming tax-receipted donations on the decline, the total amount of money being donated keeps rising. What accounts for this paradox? Affluent donors.

In 2021, 5,530 donors accounted for a staggering 23 per cent of the total tax-receipted donations claimed by Canadians, according to the CAGP Foundation and KCI report. Further, it’s these very donors who are turning to DAFs as a giving solution.

Excluding the Charitable Impact Foundation, the average donor advised fund in Canada held assets of over $400,000 in 2021. That sum is more than the total assets that 40 per cent of Canadians have to their name — let alone have to give away. (In 2019, Canadians in the bottom 40 per cent of the asset pyramid had less than $302,678, according to data from Statistics Canada).

While a few foundations are trying to “democratize” the use of donor advised funds, the report lists several reasons why it’s affluent donors who are turning to the giving vehicle most.

Chief among them is that DAFs tend to be more useful for affluent donors from a tax perspective. Many donors establish DAFs in a year when they sell their business, conclude a divorce, or any other moment when their taxable income is higher than an average year. Making a donation to establish a DAF allows them to claim the full value of the donation in the year their income is higher, reducing their taxes more than if they decided to make individual donations to charities over time.

Additionally, as reported by Future of Good, there has been considerable growth in the number of financial institutions offering donor advised funds to their clients, through affiliated DAF foundations. It’s affluent donors who tend to work most closely with financial advisors at these institutions, and who are thus the biggest target of the new marketing of DAFs.

Most DAFs are invested traditionally, but donors increasingly want impact investment opportunities

The new report also found that just a quarter of DAF foundations offer their fund holders the option to invest their charitable assets in socially responsible or impact investment funds. The rest, by contrast, require funds to be held in traditional portfolios, which can include holdings in fossil fuel companies, among other investments that may be misaligned with donor’s values and their charitable objectives.

Sjogren says, however, he believes change is on the horizon in this area pushed by donor’s desires: “It’s not necessarily being driven by the foundations, it’s being driven by the donors.”

Report shows DAF foundation market concentration, and community foundations retaining strong market share, despite new entrants

While there are just 70-odd foundations that offer donor advised funds, just six of them netted 66 per cent of all donations made into DAFs in 2021, according to Sjogren’s report. Among these six foundations, three have tight links to the country’s banks and wealth management firms.

Charitable Gift Funds Canada, for instance, netted 18 per cent of all DAF donations in 2021, according to the report. CGFC serves hundreds of financial advisors who work for the Bank of Montreal and Royal Bank of Canada, among other financial institutions.

The report also notes that while in recent years, independent and financial institution-affiliated DAF foundations have increased their market share, community foundations still retain nearly half of the total DAF market in Canada, as measured by total DAF assets. This is a far larger share than in the United States, for instance, where just 27 per cent of DAF assets are held with community foundations, or the UK where just 10 per cent of assets are held with community foundations, according to the report.

DAF assets projected to reach $12.5 billion by 2025

If Sjogren and Bannon Waterman are correct, fundraisers like Yvonne Harding are going to start seeing an increasing number of DAF grants showing up in their charity’s accounts.

The report predicts DAF assets will grow to $12.5 billion by 2025, propelled by the vast intergenerational wealth transfer taking place between generations, and by financial advisors increasingly marketing DAFs to their clients, among other drivers.

“They’re here to stay,” Sjrogen says. “We’ve got to get over fighting over whether they’re good, bad or different; and we’ve got to get over the ‘hoarding’ issue.’”

Correction: A previous of this story said that one in four charities received a DAF grant in 2021, based on text from the published report. Following publication of this story, researchers clarified, however, that the more accurate figure is one in five charities (18 – 20 per cent of charities), as the prior statistic did not account for charities who received multiple grants.