Here's why community capital institutions could be the key to recovery

Why It Matters

The United States puts more than $1 billion per year into a fund for community development financial institutions (CDFIs), and mandates that big banks make investments into low-income neighbourhoods, which they do by lending to CDFIs. Canada doesn’t have similar institutions that could classify as CDFIs, but if we did, hundreds of millions of dollars could be catalyzed to support communities’ recovery and regeneration.

As we continue to navigate through an incredibly challenging moment in time across North America and around the world, there is a critical need to maintain, improve, and launch systemic responses — like wage subsidies, income support programs, rent abatement programs, and sector stabilization funds. We’ll also need to renew our collective social contract, as the crisis has revealed the stark nature of long-standing issues that must be addressed, from precarious work to incredible inequality.

Additionally, there is a need to unleash the power and potential of social enterprise and impact investing as a part of a comprehensive response to the social and economic impacts of COVID-19. As a movement, we need to lean in at this time.

In the United States and Canada, both Nonprofit Finance Fund (NFF) and SVX have been working collaboratively with partners on ecosystem responses. In Canada, we have sought to develop a greater understanding of the trends, gaps, principles, and models, alongside a long list of potential response actions. Following conversations with communities, we have identified three priority actions to address the need for capacity, capital, and systems infrastructure to provide short-term emergency relief and support medium to long-term recovery and regeneration. We’ve launched the Impact Response campaign to build an engaged movement behind these actions.

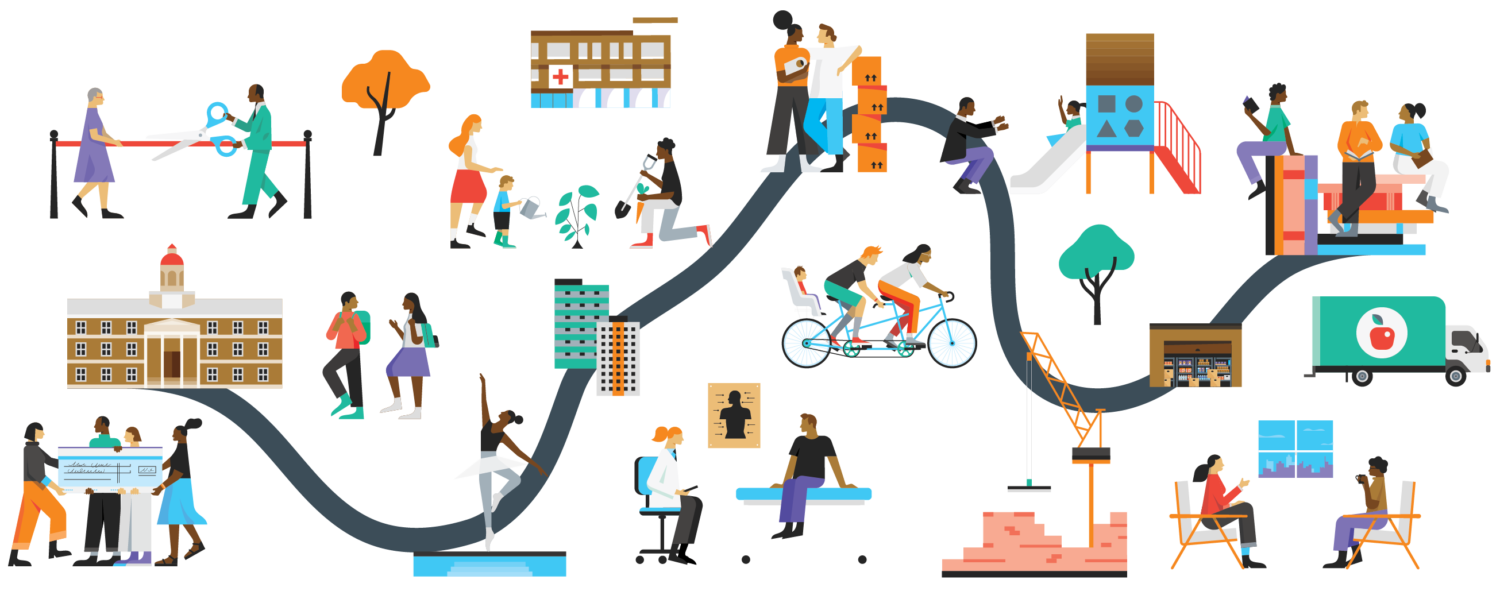

Among the key actions we’re calling for is developing a new framework to identify, qualify, and provide ongoing support to a new category of community development financial institutions (CDFI), which exist in the United States and United Kingdom, but haven’t made it to Canada yet. These community capital institutions could help lead recovery and regeneration efforts across the country, and provide long-term systems infrastructure that can support local communities, businesses and nonprofit organizations.

What is a community development financial institution (CDFI)?

Community development financial institutions (CDFIs) provide credit and financial services to people and communities underserved by mainstream commercial banks and lenders, including communities of colour, rural regions, urban centres hit by economic decline, and Indigenous communities. The term CDFI can be used to describe a range of nonprofit and for-profit entities, including community development banks, community development credit unions, community development loan funds, community development venture capital funds, and microenterprise loan funds. By financing community businesses — including small businesses, microenterprises, nonprofit organizations, commercial real estate, and affordable housing — CDFIs spark job growth and retention in hard-to serve markets across the country. In the case of COVID-19, CDFIs have been mobilized as financial first responders to the crisis, providing a range of capital and capacity assistance for nonprofits, local businesses, and social enterprises in the US.

In the United States, more than 1,200 CDFIs are registered with the federal Treasury Department which makes subsidies available to support their work. For instance, Nonprofit Finance Fund is 40-years old and now operates nationally out of five offices, making $50-70 million in investments each year. As part of the crisis response, NFF partnered with private foundations in New York City to set up a $37 million loan fund to provide interest-free loans to human services and arts organizations dealing with delayed payments and donations. NFF is replicating this zero-interest loan fund across the US in partnership with five family foundations.

Many CDFIs also operate locally, including Optus Bank, in Charleston, South Carolina, one of less than 20 remaining Black-owned banks in the United States. During the crisis, they have focused on helping minority-owned businesses in their community access the federal small business relief program which, though theoretically open to all small businesses, has disproportionately been accessed by larger, white-owned firms. As with other small, local CDFIs, Optus has been a crucial bridge between the federal program and the minority small business owners who the large banks too often ignore or under-value.

As with other small, local CDFIs, Optus has been a crucial bridge between the federal program and the minority small business owners who the large banks too often ignore or under-value.

As a sector, American CDFIs are responding to the COVID-19 crisis through collective organizations like the Opportunity Finance Network (OFN), employing coordinated responses, including a national partnership with Google to deploy $125 million to help thousands of small businesses hardest hit by the COVID-19 pandemic and joint advocacy to increase federal grant support for CDFIs.

How could community development financial institutions (CDFIs) work in Canada?

Fortunately, Canada already has CDFI-like institutions and infrastructure that represent a foundation to build upon. There are dozens of organizations that would fit the profile of a CDFI, from community loan funds to place-based equity funds. In some ways, the Canadian CDFI movement may be driven by unifying, organizing and categorizing a range of existing institutions that have a community capital mandate. But existing institutions can be fragile, because of a lack of infrastructure and resources, so significant gaps remain in the availability of services. It will also be important to support the development of new institutions to fill capital gaps that exist for enterprises, intermediaries, and nonprofit organizations. Moreover, it will be necessary to provide ongoing support and new tools to support existing and new institutions to advance recovery and regeneration efforts at a local level.

This new and unified category of community capital institutions could target regions and target populations including women, rural and Northern communities, Indigenous communities, and urban areas most impacted by the crisis. It could also target community economic development in regions that have faced structural social and economic challenges. In rural regions, new community capital funds could expand the range of capital and capital options provided by existing community futures organizations, either through the creation of new funds or through partnerships with other existing organizations.

The framework for qualifying and funding Canadian CDFIs could be modelled on the CDFI Fund in the United States. Essentially, catalyzing a community finance sector requires two sources of capital: subsidy to enable community lenders and investors to grow and incentives to motivate mainstream financial institutions to provide risk capital to community investors. The United States has both: in the CDFI Fund, which puts out more than $1 billion each year in grants to CDFIs, and the Community Reinvestment Act, that since 1977, has mandated that large banks make investments in low-income neighbourhoods which they often do by lending to CDFIs.

In Canada, we could build similar infrastructure. This infrastructure could be supported by capital mandates from mainstream financial institutions and tax incentives to support investment into CDFIs. In the recovery phase, there will be a substantial need for capital by organizations and enterprises, as well as by place-based funds seeking to raise and deploy capital into these organizations. Many major Canadian financial institutions have significant amounts of capital available on their balance sheet. In line with similar regulations in the United States, there could be regulatory mandates for chartered financial institutions to ensure they dedicate a certain percentage of their capital to investing in local organizations, businesses and funds that are driving recovery and regeneration.

In line with similar regulations in the United States, there could be regulatory mandates for chartered financial institutions to ensure they dedicate a certain percentage of their capital to investing in local organizations, businesses and funds that are driving recovery and regeneration.

Moreover, Canada’s federal government and provincial governments could create tax incentives for individuals to invest in CDFIs. There are already models in place in both British Columbia and Atlantic Canada. This combination of capital mandates and incentives could mobilize hundreds of millions in capital for organizations and enterprises that need access to capital for adaptation, relief, and recovery.

CDFI infrastructure has filled critical gaps in the US, as these organizations have acted as financial first responders to the social and economic impacts of the COVID-19 crisis. They have provided grants and loans to small businesses on Main Street and to non-profit organizations providing critical front line services to millions of Americans.

A comprehensive and coordinated system of CDFIs could have put Canada in a much better position to respond to the economic impacts of the crisis. And the country would also have been better positioned to address critical capital gaps that already existed before the crisis.

There is a clear need and opportunity for a robust system of community capital institutions. It is also clear that there is an open policy window to move this work forward, but it will take a concerted and collective effort to achieve progress. The social finance community can also use this as an opportunity for mutual learning and collaboration between ecosystems in Canada and the US.

Our team is working around the clock to deliver insightful stories, analysis, and commentary on the effects of COVID-19 on the social impact world. If you like our content, please consider becoming a member. Start a 14-day free trial now.