Higher growth through sustainable investment? Winners of Great Canadian ESG Championship think so

Why It Matters

How foundations, pension plans, organizations and individuals invest their assets has the power to fight climate change, nurture responsible government and drive social change. Raising awareness of responsible options can push investors towards sustainable options.

[aesop_image img=”https://futureofgood.co/wp-content/uploads/2022/11/unnamed-2.jpeg” panorama=”off” align=”center” lightbox=”on” captionsrc=”custom” caption=”Photo: Karsten Wurth” captionposition=”left” revealfx=”off” overlay_revealfx=”off”]

Eight months after its launch, winners of The Great Canadian ESG Championship — designed to showcase and reward transparent, purpose-driven investment strategies — have been announced.

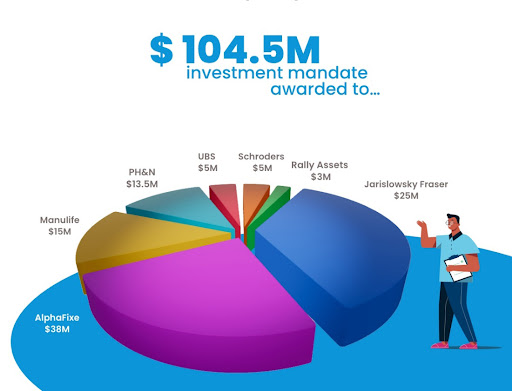

Sixty competitors spread over three categories vied for $104.5 million in assets, provided by nine co-investors: The Trottier Family Foundation, Concordia University Foundation, the Skagit Environmental Endowment Commission, the Foundation of Greater Montreal, the Sitka Foundation, the Consecon Foundation and the McConnell Foundation, as well as two private trusts.

“The competition highlighted that the Canadian landscape for responsible investing is quite mature,” said Éric St-Pierre, executive director of the Trottier Family Foundation, which organized the competition. “However, the lack of clarity around ESG labelling and definitions makes it challenging for investors to navigate.”

Driven by a growing number of asset owners looking for responsible investment opportunities, the competition’s co-investors hope the championship has shone a light on asset managers excelling in the field of environmentally, socially and ethically responsible investing.

A decade ago, investing based on environmental, social and governance criteria, better known by the acronym ESG, was a niche strategy accounting for roughly 20 per cent of both the Canadian and global market. Today, it’s a mainstream practice applied to more than 60 per cent of assets under management in Canada and close to 40 per cent of the global market.

St-Pierre said he also wanted the championship to “increase competitiveness amongst asset managers and identify the gaps where the industry can improve.” The competition concludes at a pivotal moment, he added, noting there’s been a greater scrutiny of “greenwashing” and a global tightening of regulations governing ESG financial products.

“While the appetite for responsible investment options in Canada has never been greater, neither has skepticism around what constitutes credible ESG,” reads a recent press release issued by the competition organizer.

Key learnings from the eight-month-long competition have also been aggregated into a state of the industry report.

“It became clear that some players are integrating ESG throughout their firms’ practices, but in other instances, we saw a disconnect between what funds were designed to achieve and how they were being marketed,” said Milla Craig, founder and CEO of Millani, the competition’s expert ESG validator and author of the report. “While each winning firm had their own distinct ESG strategy, what they all had in common was their ability to clearly articulate their strategy well.”

Eleven candidates were chosen as finalists and seven named as winners, including Montreal-based AlphaFixe Capital, which will receive $38 million after winning in the fixed income category. Schroders International won in the same category, along with Manulife.

They will receive $5 million and $15 million respectively.

Katherine Davidson, Schroders’ portfolio manager and sustainability specialist, described the symbiotic relationship between a company and its stakeholders as “corporate karma.”

“It shows that investing in sustainability can deliver higher growth and returns through innovation, higher operational efficiency and better risk management,” Davidson said. “We are delighted to participate in such a forward-looking tender process that recognizes the growing importance of sustainability in our industry and society at large.”

The competition’s alternatives category had one winner; UBS Asset Management, which received $5 million in assets. The firm’s Canadian head of client coverage said that UBS was one of the first to offer sustainable investment strategies and that it launched its first equities SRI (socially responsible investments) in 1997.

“We strive to remain at the vanguard by continually innovating with new ESG strategies across asset classes,” Dan Primeau said. “The Global Responsible Infrastructure Fund (GRIF) was specifically designed for Canadian institutions wishing to invest in infrastructure with a strong ESG focus.”

The third and final category, multi-assets, saw three winners: Jarislowsky Fraser, Global Investment Management; Rally Assets; and RBC Global Asset Management PH&N Institutional. They will receive $25 million, $5 million and $13.5 million respectively.

Maxime Ménard, Jarislowsky Fraser’s president and CEO, said “we hope to demonstrate solutions that reflect rigor, discipline, expertise and transparency, along with the benefit of engagement, impact and direct exposure to innovation through our Climate and Diversity & Inclusion proprietary frameworks.”