2024’s social finance victories and challenges - in quotes and graphs

Why It Matters

The 2025 Canadian social finance sector's challenges include unlocking much more private capital for intentional positive impact, pricing nature services, and growing the purpose economy.

As we tilt head-first into 2025, it’s worth looking back at 2024 to see how the social finance sector evolved.

Some of the changes we saw coming. Some of them… we did not.

Here’s a recap of the year, highlighted in quotes and graphs, sourced from our coverage and even some that isn’t ours.

January

Q: “Colonization is about extracting value from people and the land,” said Jeff Cyr, co-founder of Raven Indigenous Capital Partners (RICP). “Outcomes financing changes the direction of money. It gives Indigenous communities the tools to become stronger and more resilient,” he said.

Q: “A lot more government money goes into procurement than funding,” said Shaun Loney, co-founder of Aki Solutions Group, one of those contractors. “Indigenous providers want to be recurrent actors in the procurement process and benefit from this equal relationship.”

A primary component of the outcomes financing model is that local organizations are contracted to deliver those outcomes.

Read more: Canada’s Social Finance Fund’s First Investment Champions Outcomes Financing

March

Q: “We want to build the case that as an investor, you are better off considering women and children,” said Alexander Rostami, head of the UNICEF Office of Innovation.

UNICEF defines Child-Lens Investing (CLI) as “a strategy focusing on “children as intended beneficiaries and affected stakeholders and the elevation of positive child impact – either directly or indirectly – as an objective.”

In February, it was looking for investors to test CLI.

Read more: UNICEF looks to test its child-lens investing framework

Q: “The ultimate goal is for Quebec workers in all sectors to become socio-economic players in their own right. It’s a question of empowerment, of getting control over your financial life,” said Jeannot Bradette, senior manager of the Economic Training Centre of le Fonds de Solidarité FTQ.

Fonds de Solidarité FTQ provides basic economic training to its members to demystify economic cycles and company workings so workers understand their contribution to productivity and the employer’s sustainability.

Read more: Financial literacy as an antidote to stress

Q: “For every new affordable rental home built in B.C., four more are lost to investors, conversions, demolition and rent increases,” said Katie Maslechko, CEO of the Rental Protection Fund.

In January 2023, the province of B.C. announced the Rental Protection Fund, a $500 million initiative helping non-profits buy buildings with lower-than-market-value rents. The fund covers the equity gap between the price the non-profit should pay to keep rent affordable and the market price it needs to pay.

Designed as a pilot project, the B.C. Fund paved the way for the announcement on April 14 of the Canada-wide $1,5 billion Rental Protection Fund.

Read more: The B.C. pilot project that prevents affordable housing loss

May

Q:“Based on the sustainability information, investors may choose not to invest in or sell their stocks. Investors may be driven by personal values, risk perception, or a little of both. In the end, the sustainability information disclosed may influence the capacity of a company to attract investment. That is why regulatory authorities’ decisions should be followed closely by stakeholders of the impact sector.” Milla Craig, President and CEO, Millani

Read more: Will Canada follow in Europe’s footsteps and regulate greenwashing?

June

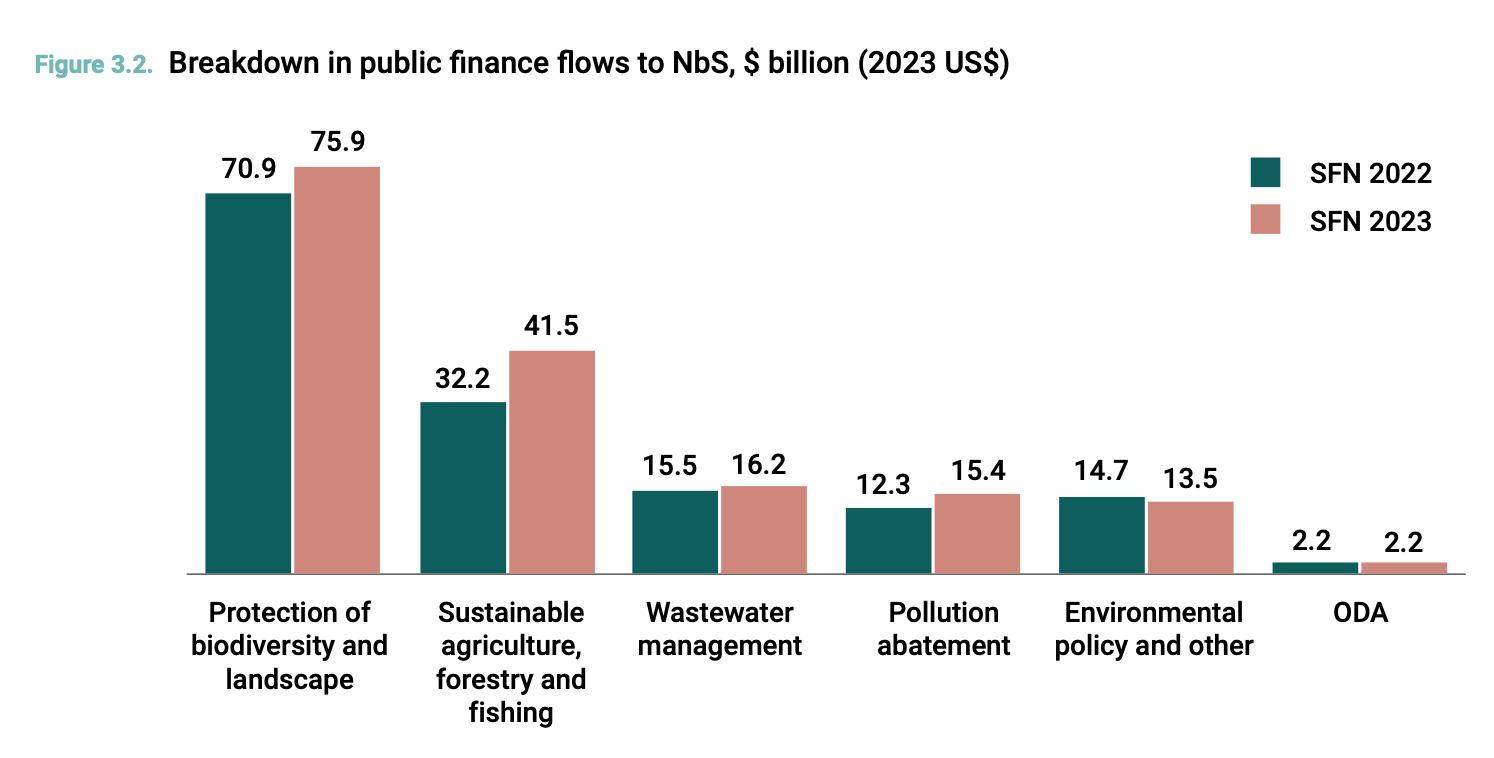

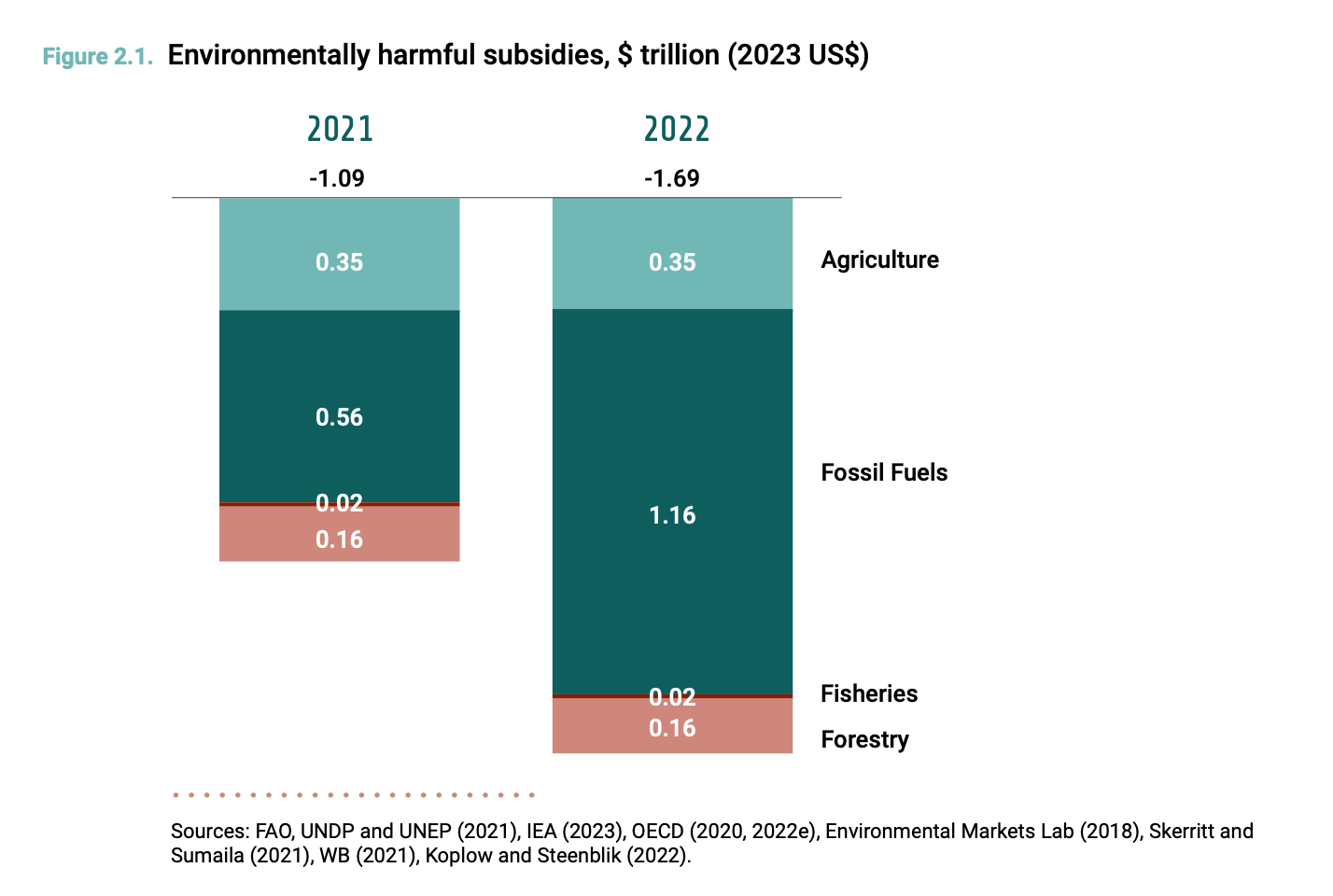

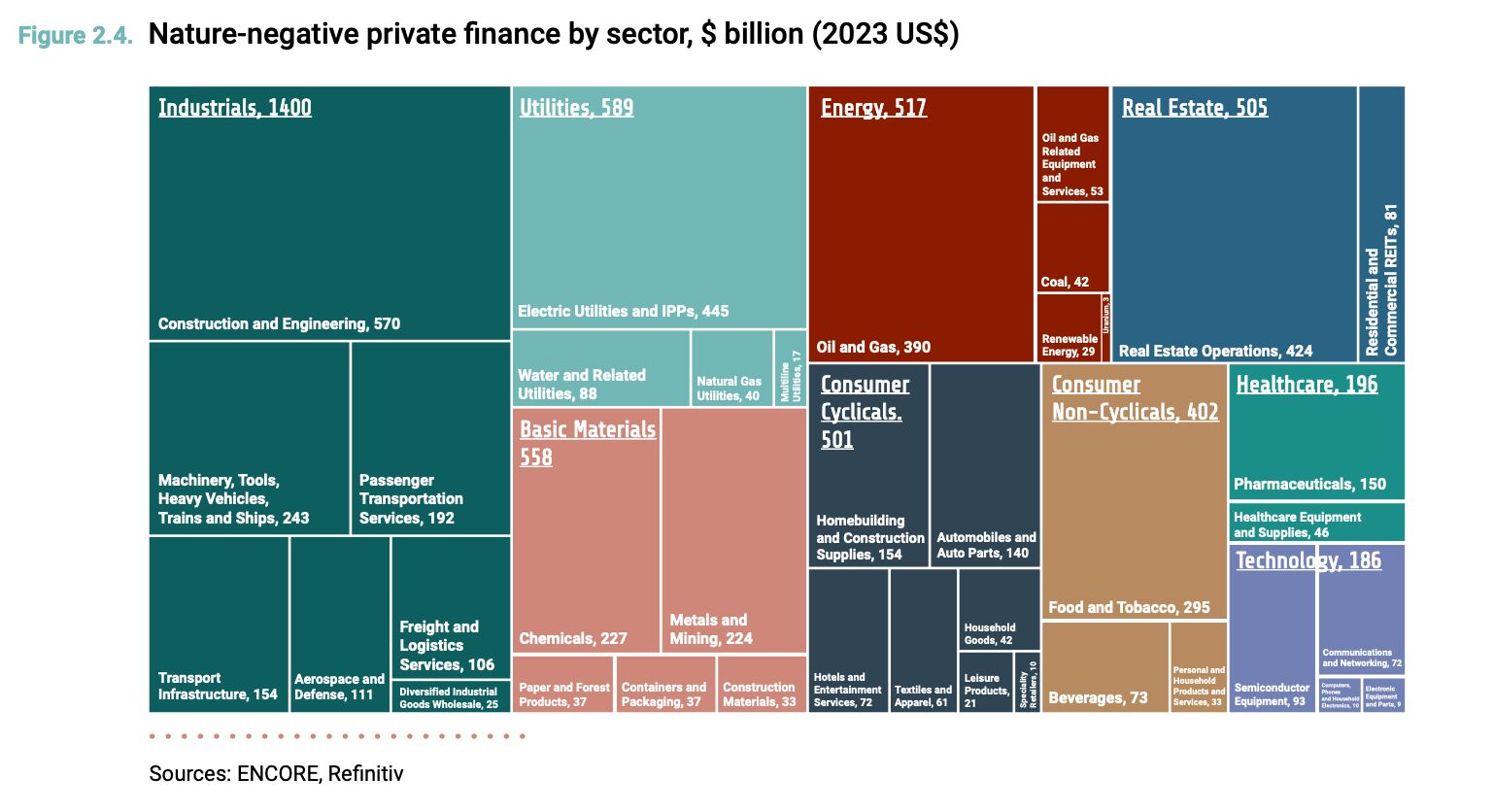

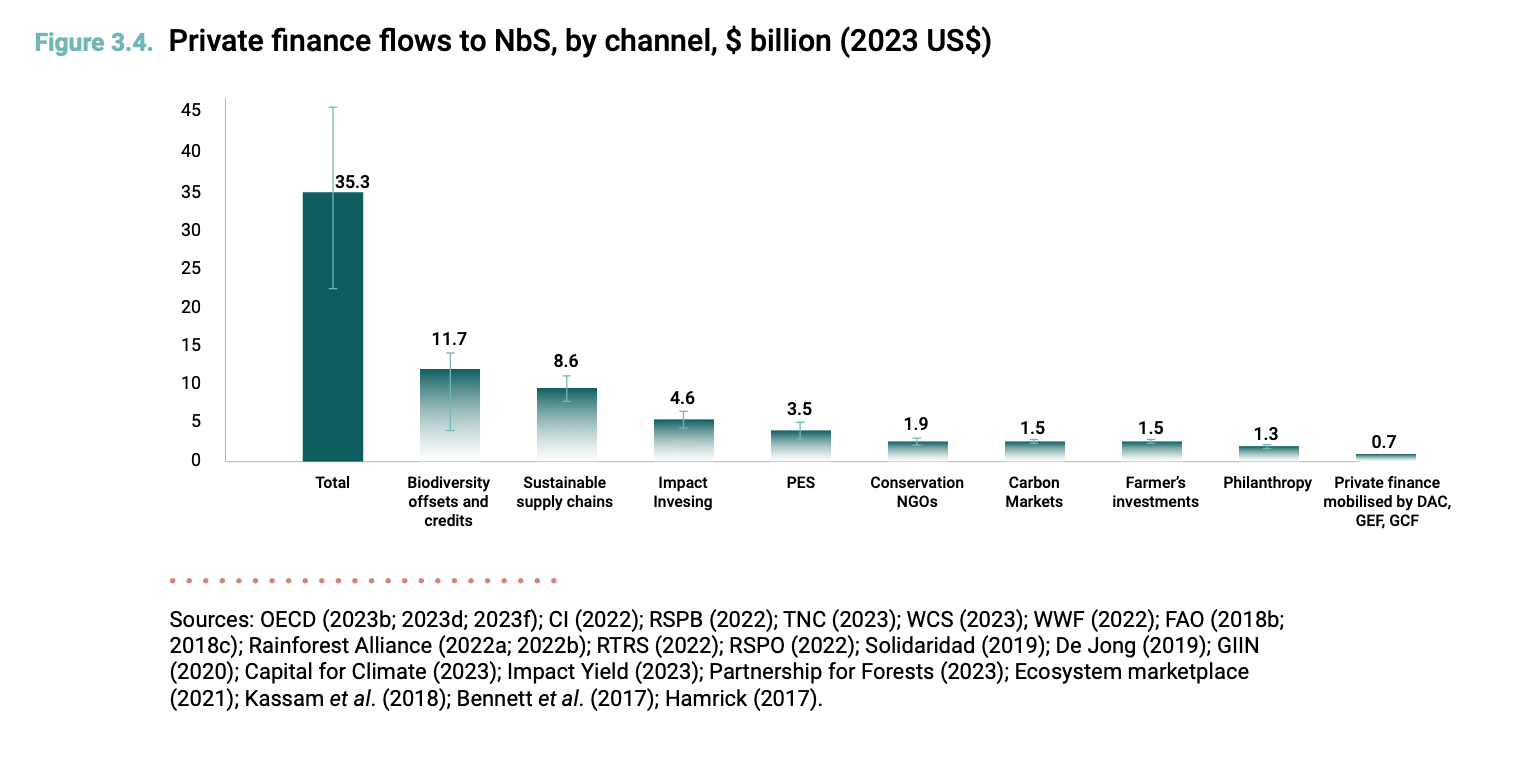

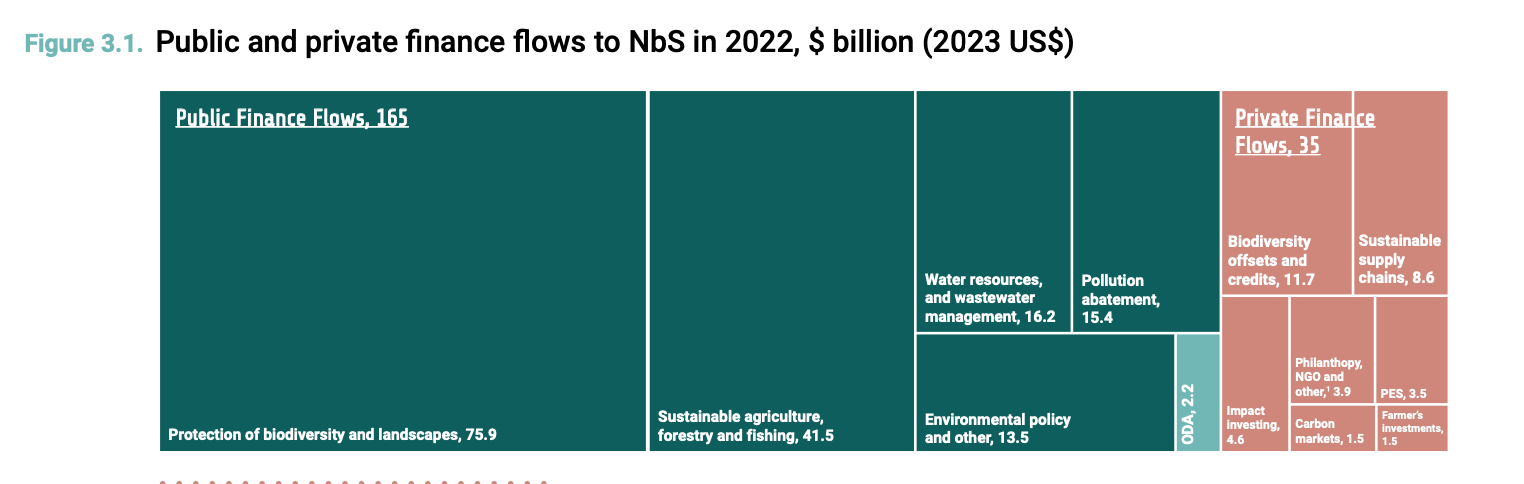

State of Finance for Nature, UN Environment Program, Global Canopy, The Economics of Land Degradation

Below: Tracked nature-negative public finance flows, like environmental harmful subsidies, are more than 10 times greater than public finance flows to NbS.

Below: Private nature-negative finance flows are 140 times larger than tracked private investments into Nature-based Solutions.

Below: The total annual finance flows to NbS in 2022 is only one-third of the finance needed by 2030. Governments continue to lead, providing 82 per cent of the total.

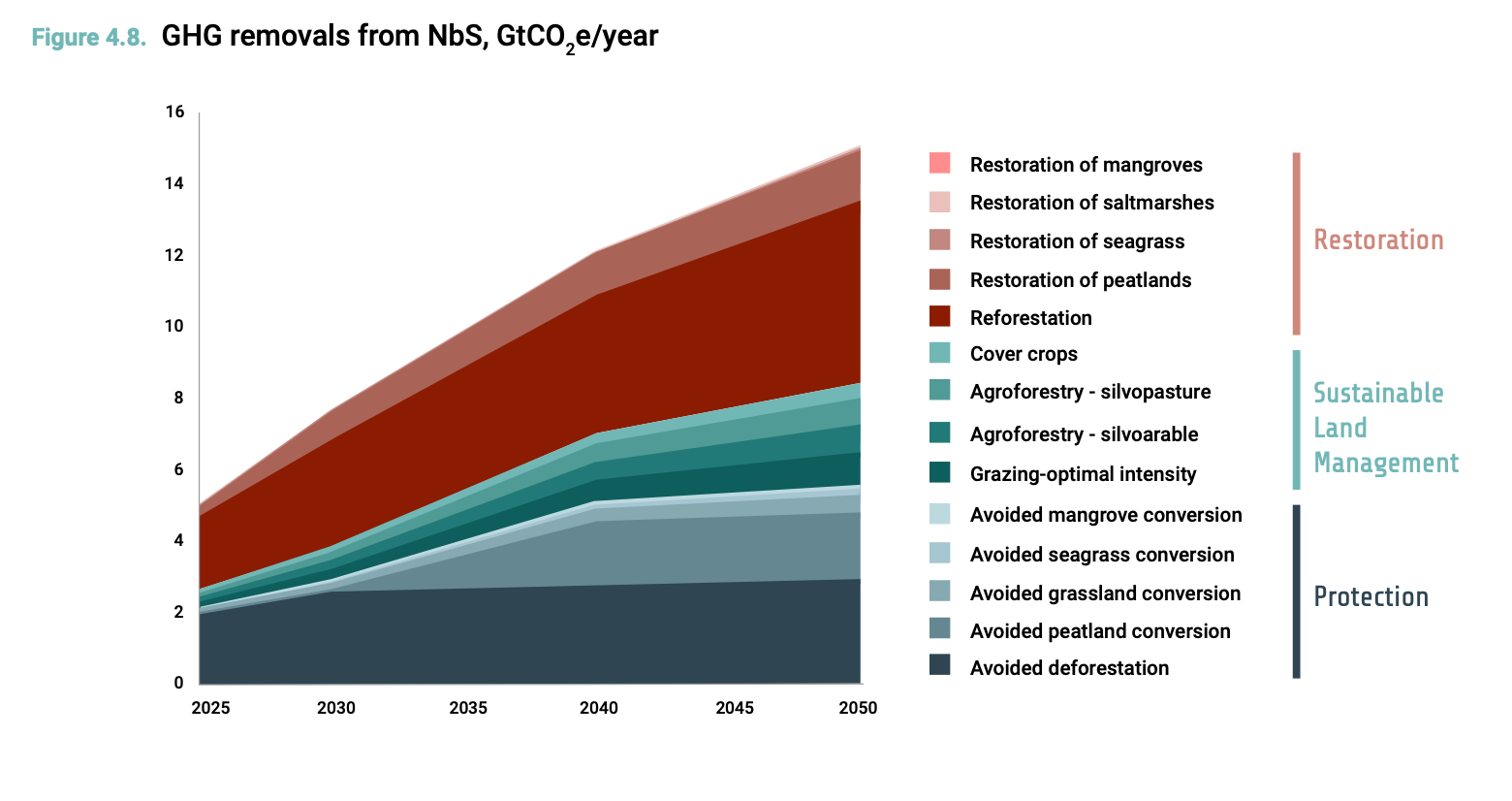

Below: In the Rio-aligned scenario, net deforestation would end, and reforestation would scale significantly by 2030, resulting in 7.7 GtCO2e per year in GHG removals. More costly NbS, such as peatland restoration and agroforestry, would scale significantly to 2050, contributing to a total of 5GtCO2e per year in removals.

July

Q: “Blended finance is a balancing act. Government can’t take all risk while private investors take none.” – Nathan Cohen-Fournier, former head of social finance for the Chagnon Foundation.

Blended finance’s strength is the combination of various risks and returns. However, the returns possible from social projects are limited. Private investors’ returns crafted in a blended finance contract should not compromise the affordability of the units, for instance.

Read more: Blended finance: A Canadian way to raise funds, but happening mainly in Quebec

August

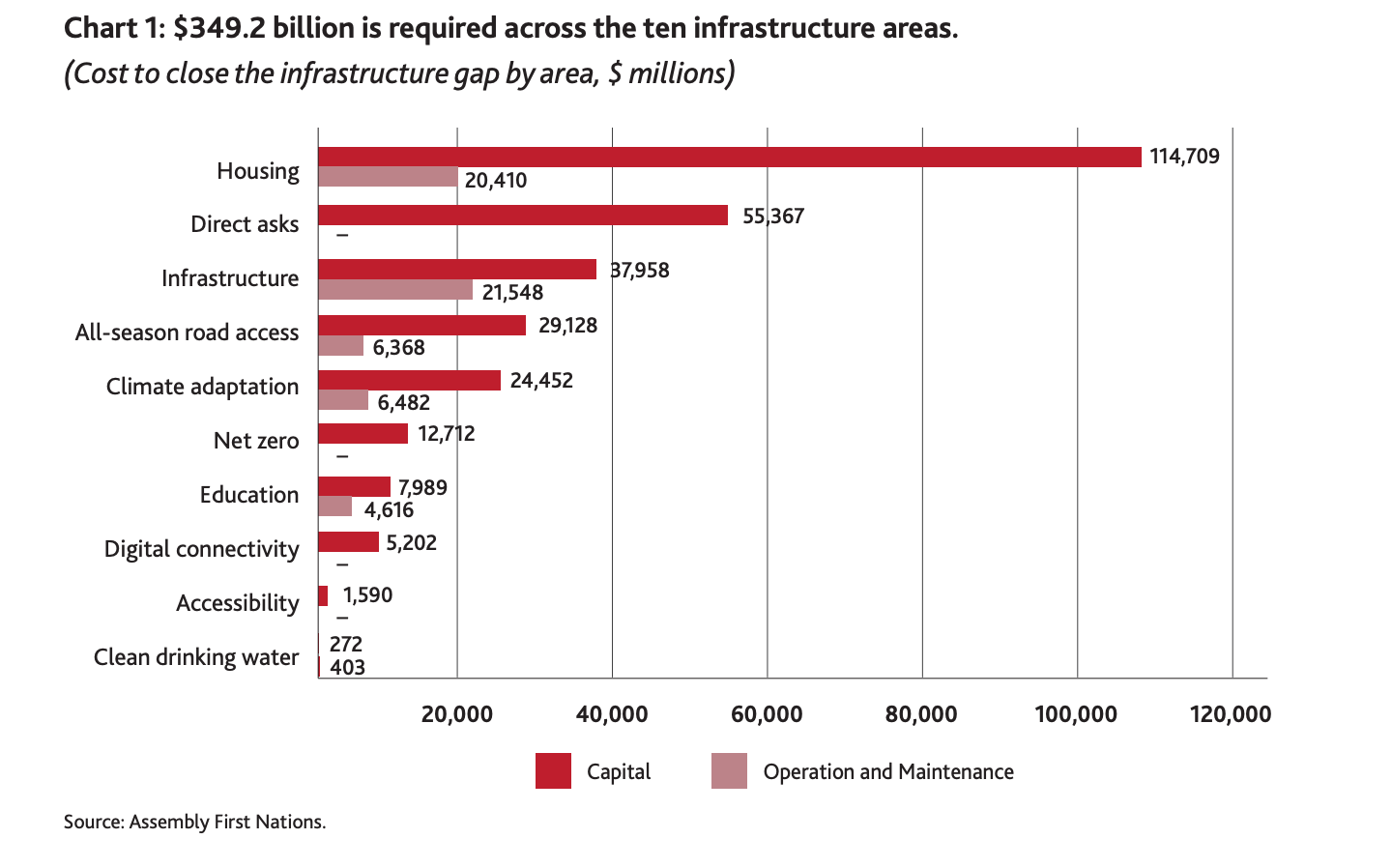

Economic Impact of Closing the Infrastructure Gap” ( for Canada’s First Nations), Conference Board of Canada

Capital investments cover the fixed one-time expenses incurred during a project’s construction phase, including the purchase of related equipment. O&M investments are expenses incurred during a project’s operational phase to ensure that an asset achieves its planned lifespan, including repairs and replacement of components.

September

Q: “A private developer must pay a fee not to build social housing. But that cost can’t be too high, or the developer can’t do the project. There is a sweet spot between the amount you can charge a private developer and the subsidy you can attribute to non-profits to help balance everything,” said Jordan Owen, junior partner at Mondev.

Under current circumstances, it’s difficult for anyone to build housing units at market price or affordable and social units. Different formulas are tested, and partnerships between promoters and non-profits are one of them.

October

Q: “Language is super important, and our words have an impact. From right to left to the middle, everyone wants to invest back in their community. UK community investment tax relief was first labelled social investment tax relief. Social finance is valuable, but community finance is strong and resonant for all.” – Adam Spence, CEO at SVX, Catalyst Community Finance Initiative member.

Read more: 4 Canadian suggestions to increase community finance funds

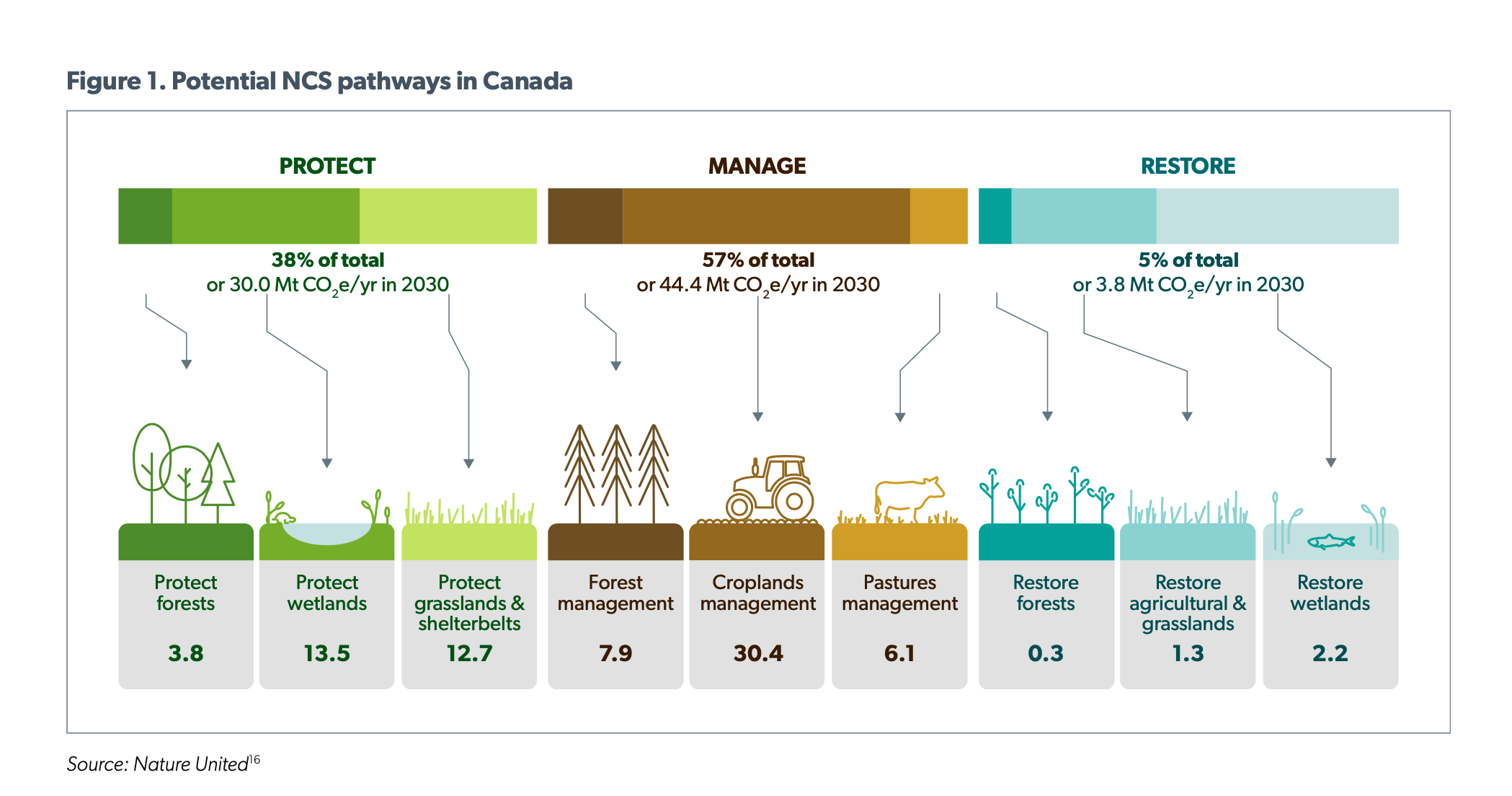

Below: Unlocking the Economic Power of Nature Climate Solutions, Smart Prosperity Institute and Nature United

These pathways can immediately reduce emissions in Canada without compromising economic growth, affordability and community resilience.

Q: “It is a change of culture for community housing promoters to use capital, not subsidies, to complete a project.” Nancy Croussette, Senior Advisor to General Management, Quebec Association of Technical Resources Groups

AGRTQ proposes two patient capital funds – a $20 million Fonds Immosocial Québec and a $151 million Capital Social d’Investissement immobilier. Both have a 15-year repayment period. The non-profit developer repays the capital using the return on the building. Repayment is made from the surplus. Patient capital could accelerate the supply of off-market housing.

Read more: Proposed housing solution: A Quebec hub to accelerate affordable housing financing

Q: “Canada is a resource-producing country. It adds to the challenge when an economy includes sectors that naturally do not contribute to decarbonization,” said Jacques Desforges, General Manager of Finance Montréal.

Q: “Carbon capture is a transition investment. However, there is a risk of ‘carbon lock-in,’” said Florian Roulle, VP of Sustainable Finance at Finance Montréal.

Carbon lock-in refers to the concern that investments in carbon-intensive infrastructure today will delay or foreclose a clean energy future by making it too difficult or expensive to transition to alternative energies, thereby ‘locking’ a country into a fossil fuel-dependent development pathway. Significant investments in carbon capture technology might lead to exploiting natural gas deposits beyond what science suggests to repay investors.

Read more: Q&A: How will Canada define what a ‘green’ investment is?

November

Q: “People enroll less in clubs and attend fewer public meetings; union membership and church attendance are declining. As what binds with other humans weakens, so does the consideration of our impact on others. If you take it to the next level, so does the consideration of the impact of businesses and governments on society.” – George Guerrero, CEO, Just Futures

Social capital defines positive impact investments and refers to the fabric that binds communities. They are two components of one definition. How can positive impact investments be efficient without sufficient social capital in communities?

Read more: SOCAP recap: The two faces of social capital

Q: “The loss of nature and biodiversity in cities is happening at a devastating rate. We do not have time to discuss and convince investors of the value of ecosystem services to society to attract their money. The bonds take that whole debate off,” said Anastasia Morougova Millin of Ombrello Solutions and DanSa Capital Innovation.

This bond challenges the traditional finance assumption that whoever provides capital takes ownership.

Accredited investors, likely pension funds and family offices, buy civic infrastructure bonds. The proceeds allow the purchase of lots in different cities and offer diversified solutions to investors. The land is then transferred into a fiduciary structure. It no longer has an owner; it only has fiduciaries guarding its conservation mission.

The bonds will be repaid with a portion of the added value of properties up to one kilometre from the park.

Read more: SOCAP recap: Civic infrastructure bonds, or how to make money by building community parks

December

Q: “The community respects us more because we care. They discovered that we bought a business and transformed it into a social enterprise. The term ‘social enterprise’ was new, and people asked what it meant. They liked it.” – Lori Camire, executive director of Community Futures Alberni-Clayoquot

Social acquisitions happen when a conventional enterprise is bought and restructured into a social economy or purpose organization. There is an awareness challenge; most non-profits don’t know they can acquire companies.

From other publications

Q: “Creating a greener future is a priority for the Mi’kmaw Nation (…) This investment in battery storage is a significant step toward true economic reconciliation and developing a more sustainable future for all Mi’kma’ki,” said Crystal Nicholas, President of Wskijinu’k Mtmo’taqnuow Agency Ltd.

Canada Infrastructure Bank announced its first Indigenous equity loan. A corporation co-owned by 13 Mi’kmaw communities will receive up to $18 million in an equity loan to invest in new battery plants in Nova Scotia. This project is in partnership with Nova Scotia Power.

CIB aims to invest at least $1 billion in Indigenous infrastructure by accelerating projects and providing access to capital.

Q: “In 2023, funding to Black entrepreneurs was at a historic low of 0.48% of total venture capital funds deployed in the U.S. In Canada, the situation mirrors these statistics, revealing systemic barriers that prevent Black entrepreneurs from accessing similar levels of capital as their peers,” said Issac Olowalafe Jr. and Lisa Birikundavyi.

There’s been a consistent yearly decline in funding since the murder of George Floyd in 2020, which saw a record-breaking amount of capital flow to Black founders as the technology industry promised to support them better.

TheFutureEconomy.ca, April 4

Q: “Investing through an environmental, social and governance (ESG) lens has lost its way in recent years, a shift that money manager François Bourdon blames on “sustainability tourists” – and not the travel kind. The managing partner of sustainability-focused firm Nordis Capital, based in Montreal, says too many companies venture into sustainability in one part of their business while maintaining other parts that can be harmful to society and the environment,” according to Brenda Bouw.

–The Globe and Mail, May 3

Q: “ESG can paint a relatively decent picture of how a company operates — like employee compensation or board composition — but not necessarily what it actually does. For that, impact investing is a more appropriate measure. Impact investing tends to focus not just on the fairness of internal operations but also on the actual products and services of a company. Is a company providing products and services that actively contribute to the solutions of the world’s most pressing social and environmental challenges?” asked Jory Roren, Director of Finance and Impact Investment of InSpirit Foundation.

The Toronto Star, Opinion, Nov.24