Hey Tim: Do Sustainable Funds Earn Lower Financial Returns?

This is one of the most common questions I get — and I get why. There’s a persistent myth out there that if you invest sustainably, you’re sacrificing returns. The loudest voices on the right love to shout “Go woke, stay broke,” but the data tells a very different story.

The truth is that sustainable investors can earn near-identical financial returns to traditional investors. The key is understanding the difference between doing less evil and doing more good.

Let’s start with doing less evil. These strategies use environmental, social, and governance (ESG) data to put a little less money into companies with high ESG-risks and a little more money into sustainability leaders. Doing less evil also includes shareholder stewardship (using your voting power to influence corporate behavior) and divestment (completely avoiding sectors like tobacco or fossil fuels). These approaches are designed to track the broad market — not beat it, not lag it.

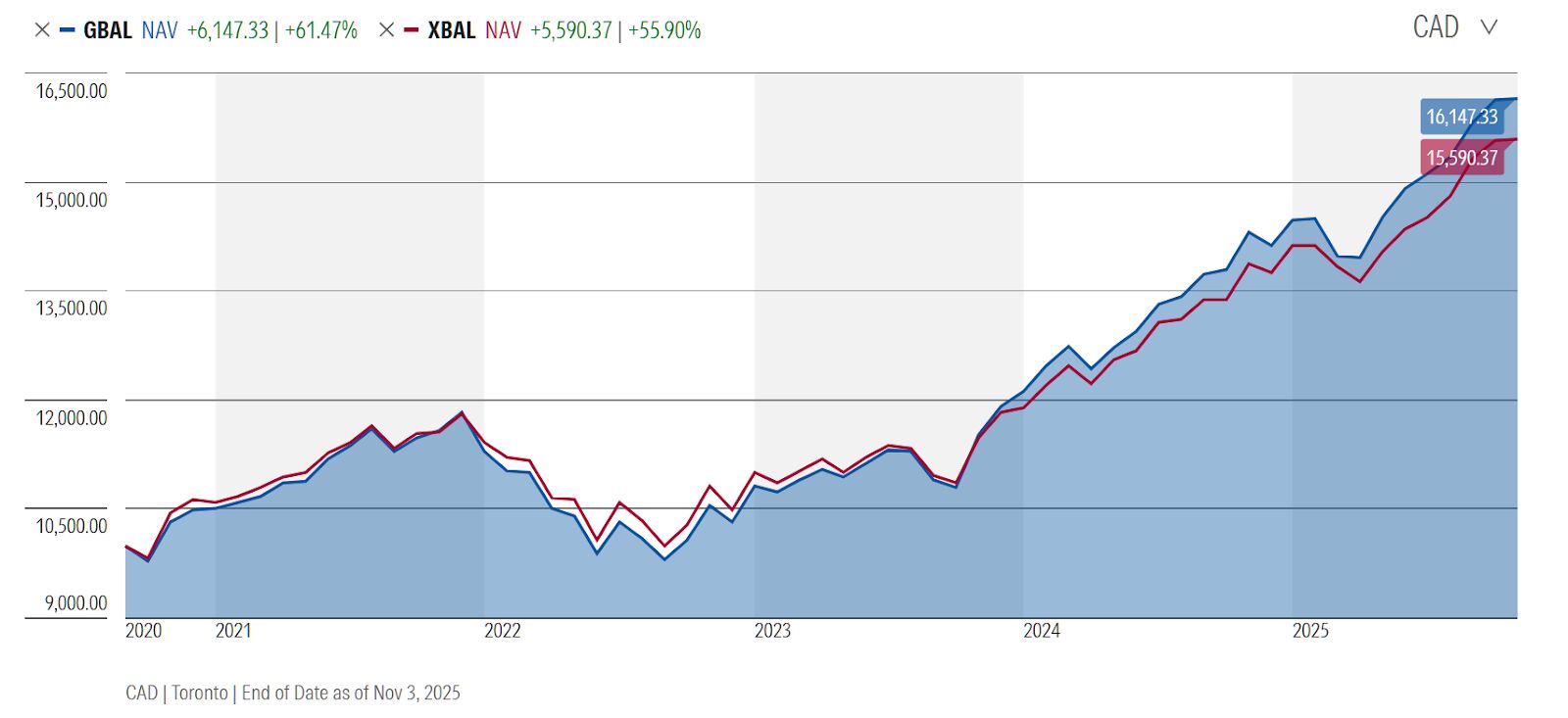

For example, let’s compare two balanced exchange-traded funds (ETFs):

- The iShares Core Balanced ETF Portfolio (XBAL) — a traditional fund.

- The iShares ESG Balanced ETF Portfolio (GBAL) — its sustainable twin.

Over the past five years, their returns have been nearly identical — in fact, GBAL has slightly outperformed. This is what I mean when I say sustainability doesn’t have to cost you returns. You can do the right thing without sacrificing performance.

Now, doing more good is a bit different. Impact investments, like community bonds or clean energy projects, aren’t built to mirror the broader market. Some years they’ll outperform; other years they’ll underperform. Each one needs to be assessed on its own merits, weighing risk, return, and impact.

There’s an ongoing debate in the impact investing world about whether these investments should target “market-rate” returns or whether investors should “concede” a slightly lower return in exchange for measurable social and environmental benefits. Personally, I think it depends on your goals.

If you want to stick close to the market while aligning your values, doing less evil funds are a great fit. If you’re ready to push the envelope — to make a tangible difference — then layering in some doing more good investments makes sense, even if the financial returns deviate a bit from year to year.

Either way, sustainable investing isn’t about choosing between doing good and doing well. It’s about finding the balance that reflects who you are and what you care about.

And if you’re ready to align your portfolio with your values, reach out. I’d love to help you find the mix of returns and impact that feels right for you.

Join us in the Classroom—your future self will thank you.