App designers hope to help Canada's arts sector gig workers better understand taxes and finances

Why It Matters

The majority of workers in the arts are self-employed and likely have incomes that fluctuate month to month. The designers of the new app Sai hope to help artists navigate Canada’s weird and wonderful tax system more easily.

Former theatre producer Owais Lightwala recalls a budgeting workshop he ran for emerging artists, teaching them about harmonized sales tax (HST). At one point in the seminar, someone started crying.

“I stopped the workshop and asked them what was wrong,” Lightwala said.

“They said: ‘I am just so overwhelmed. I have no idea what HST is, and I’ve never done this. Am I going to jail?’”

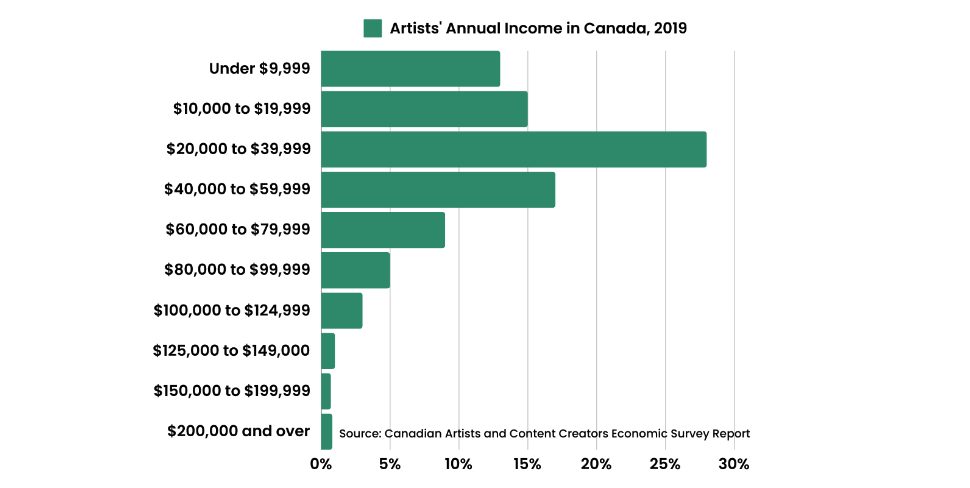

Money is an emotionally loaded topic for artists, he realized. Not only is the typical income of an artist 39 per cent lower than all Canadian workers, but the Canadian tax system can also become a minefield for self-employed people, who make up 68 per cent of all Canadian artists.

To solve that problem, Lightwala—who was managing director of Why Not Theatre for eight years and is currently an assistant professor at Toronto Metropolitan University’s Creative School—founded Sai.

The newly launched app helps creatives manage their finances, and it is funded by the Canada Council for the Arts’ Digital Strategy Fund and Canadian Heritage’s Strategic Initiatives Fund.

Self-employed artists and creatives can track income streams, expenses, and write-offs and provide monthly tax estimates to help users set aside money for tax season.

“I am convinced that the [existing] tools suck,” Lightwala said. “And one of the reasons they suck is because they are designed to be hard.”

“You can keep people from being empowered because it keeps an entire financial services industry and accounting industry employed.”

Why do the arts and creative sectors struggle with financial management?

Salaries in the arts and culture industry can be both low and precarious. The Government of Canada’s Job Bank shows that the median wage for a musician is less than $31,000. According to data from the Employment Insurance Survey, the highest end of an hourly wage for an artist was around $42.

Artists and creatives are also more likely to experience income fluctuations, either because of their self-employed status or because of extenuating circumstances.

In a Canadian Heritage survey of artists and content creators, a quarter of respondents reported that their income fluctuated by 100 per cent yearly. In other words, they could see their incomes halve – or double – in a single tax year.“It’s a very unevenly distributed sector in terms of who gets most of the wins. There is one Disney and a million tiny indie theatre companies,” Lightwala said.

Tax laws are not only intricate and context-dependent but also constantly changing, he added. For example, self-employed artists who receive a grant, scholarship or bursary must report this income to the Canada Revenue Agency. The language used on the CRA’s website can feel confusing and inaccessible, he said.

Creatives often end up caught in a bind: they might need an accountant or bookkeeper to help them decipher these tax laws, but many don’t make enough money to hire one, Lightwala said.

Many accountants are reluctant to take on clients from the arts and creative sector as well – the cost to provide them with a service would outweigh the business benefit to the accountant, he added.

How user experience and app design can address money anxiety

“Most artists are gig workers. They have multiple hustles or multiple jobs. How can they keep track of all of those things?” Lightwala said, alluding to the financial complexity of a portfolio career.

The Canadian Heritage survey reported that most artists and content creators felt as though they were “de facto entrepreneurs and working many hours doing all the planning, marketing, networking and administrative work that that entails.”

On average, survey respondents were spending more than 15 hours per week doing “non-creative work” that could facilitate their creative practice.

One respondent wrote to an open-ended question, “We often work more than one running gig at a time, stringing a mix of administrative and artistic work together.”

“We often need to be part accountant, performer, administrator and salesperson all at once, often without access to health benefits.”

Given this complexity, it took Lightwala and his team four years to land on the issue they wanted to address for artists and creatives. One of the apps they prototyped was an expense manager, which would help freelancers track receipts and expenses in time for tax season.

However, user feedback indicated that the expense management app didn’t get to the heart of the problem.

“Nobody is excited about organizing their receipts and expenses,” Lightwala said. “The only thing they care about is why they are organizing it. We were selling a solution to the symptom but not curing the disease.”

Sai allows creatives and artists to better manage their tax liabilities. There are already so many solutions for tax filing on the market, but Lightwala and his team kept hearing that people in the arts and creative sectors were not satisfied with them.

Free tools often expect the user to already know everything they need to know about their particular tax situations and liabilities, Lightwala said, adding many artists and creatives will not understand these nuances.

Sai is a paid platform “trying to strike the balance of being cheaper than an accountant but giving the expertise of the person who has done 10,000 tax files,” he said.

Early users feel that the platform is helping them understand their taxes better, but there is still a lot of fear and anxiety, Lightwala admitted.

Workers in these sectors cannot afford to take a risk and do not have money to lose, he said.

“There is a lot of reassurance required,” Lightwala said.

“We are building a safe and relatable system on our end with a lot of manual and expert review.”

Once he feels confident that there is a minuscule error rate, Lightwala plans to embed more automation into Sai.

Lightwala’s ambition is to add an artificial intelligence component to Sai that can understand how a self-employed creative’s income fluctuates month to month. The AI could then suggest to the user how much they should charge for their services, how they should manage their spending and expenses, and how much they should set aside for taxes.

“Eventually, we want to build digital tools that allow you to completely understand and take charge of your finances, which includes knowing where your money is going, how to manage it, and how to plan multiple projects.”