Full data: In 2020, which charities got the most donor advised fund grants from the country’s largest DAF foundations?

Why It Matters

Donation patterns are changing. Affluent Canadians are increasingly giving through donor advised funds. Which organizations DAF holders are choosing to give to will influence which charities have the necessary funds to fulfill their objectives.

This journalism is made possible by the Future of Good editorial fellowship covering the social impact world’s rapidly changing funding models, supported by Future of Good, Community Foundations of Canada, and United Way Centraide Canada. See our editorial ethics and standards here.

In Canada, affluent donors are increasingly giving through donor advised funds. By 2026, charitable assets held in donor advised funds are expected to reach $10 billion, according to research conducted by Investor Economics.

For the second half of the 21st century, Canada’s community foundations were the obvious choice for donors looking to establish DAFs. But today, there are a number of new options, including a cohort of fast-growing foundations with close ties to the country’s banks and wealth management firms.

In 2021, for instance, seven of the 20 charities that received the most donations from Canadians were DAF foundations closely affiliated with financial institutions. By contrast, just one was a community foundation.

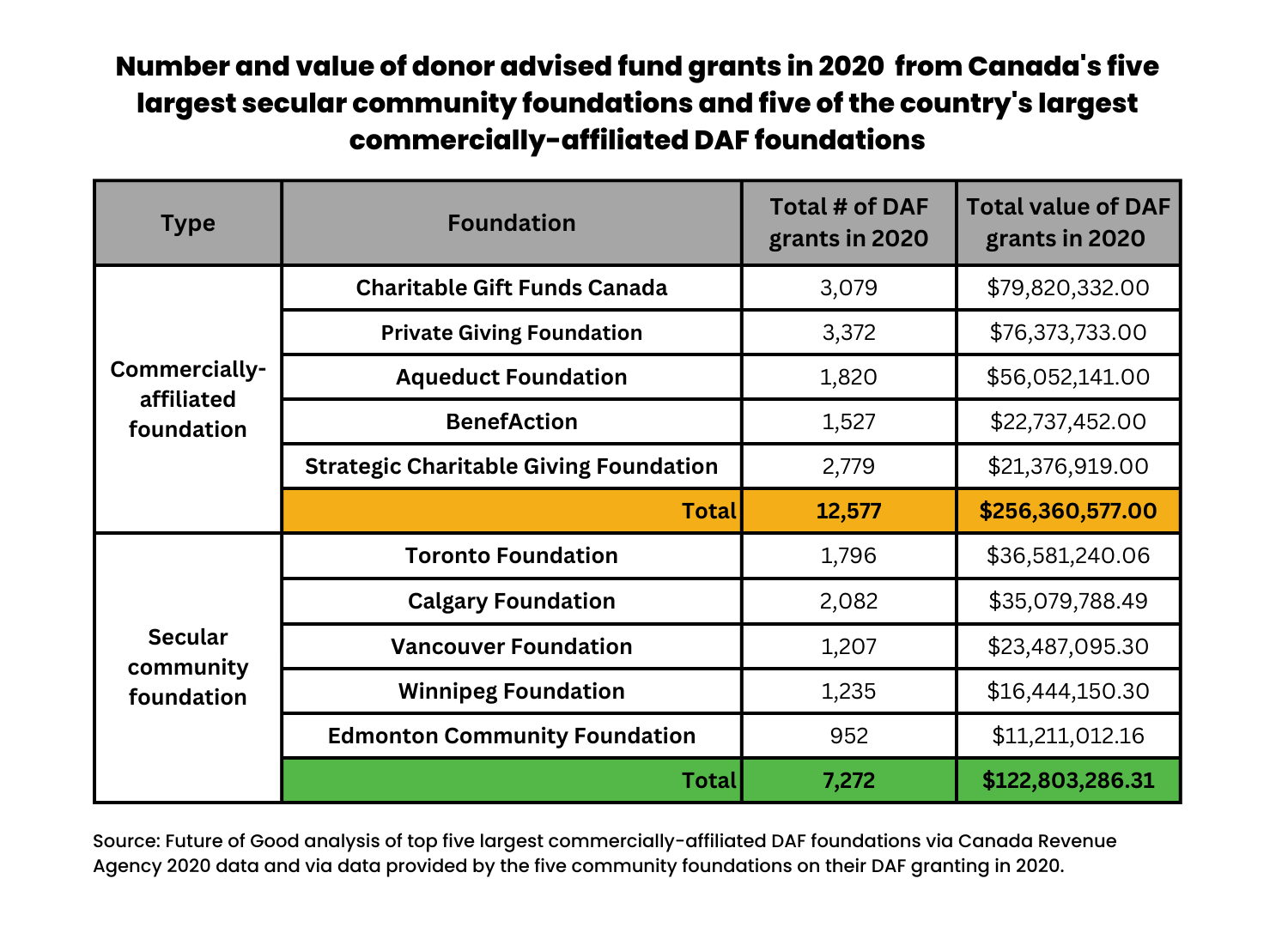

To understand whether this growth in commercially-affiliated DAF foundation funds will shift granting patterns, we compared the 2020 DAF grants from Canada’s five largest secular community foundations: Winnipeg, Vancouver, Calgary, Edmonton and Toronto, with grants from five of the largest foundations offering DAFs that are affiliated with a bank or recruit donors primarily through financial advisors: Charitable Gift Funds Canada Foundation, Aqueduct Foundation, Private Giving Foundation, Strategic Charitable Giving Foundation and BenefAction Foundation.

In our analysis, we excluded the Jewish Community Foundation of Montreal, because of its religious focus, and CHIMP: Charitable Impact Foundation, an independent Vancouver-based DAF provider, because it services thousands of everyday donors in addition to donors recruited through financial advisor connections.

We found there was a significant difference in the geographic distribution of grants between the two types of organizations. We also found a larger share of commercially-affiliated DAF foundation grants flowed to faith-based charities.

Otherwise, however, we found similarities between the grants from the two types of foundations with respect to the type, size and social impact area of charities supported.

In 2020, a disproportionate share of DAF grants from these 10 DAF foundations flowed to public and private foundations, relative to charities, and to larger organizations. By social impact area, charities focused on education, health, and poverty reductions received much more support than those focused on the environment, on the arts or on public amenities.

Number and volume of grants

In 2020, the five largest commercially-affiliated DAF foundations made 12,577 grants totalling $256 million. This donation volume was more than double the amount granted through DAFs by the country’s five largest community foundations. Combined, Toronto, Calgary, Vancouver, Winnipeg and Edmonton Community Foundation DAF holders made 7,272 grants totalling $123 million.

Charitable Gift Funds Canada, which is affiliated with Bank of Montreal, Royal Bank of Canada and National Bank, in addition to a group of other wealth management firms, granted the most in 2020 among all of the country’s largest DAF foundations, issuing nearly $80 million in grants. Toronto Dominion-bank affiliated Private Giving Foundation issued the second largest amount of grants, totalling $76 million. Scotiabank-affiliated Aqueduct Foundation granted the third most: $56 million.

Among the country’s secular community foundations, Toronto Foundation granted the most through its donor advised funds in 2020: $37 million. Calgary Foundation was next, totalling $35 million in DAF grants, followed by Vancouver Foundation, with $23 million in DAF grants.

Which charities got supported? Most support for hospital foundations, universities, private foundations, big name charities

In 2020, thousands of Canadian charities received at least one grant from the country’s largest donor advised fund. But the largest volume of grants went to hospitals, universities, private foundations and well-known charities, with a few exceptions.

In 2020, the five commercially-affiliated foundations collectively made at least one grant to 6,782 registered charities. Across all grants, the average grant size was $20,383.29 and the median size was $2,750. By contrast, in that year, the DAF holders at the country’s five largest secular community foundations collectively made at least one grant to 2,947 charities. Across all grants the average gift size was $18,974.55 and the median size was $2,500.

The single largest charitable recipient of grants from the five commercially-affiliated DAF foundations in 2020 was Charitable Gift Funds Canada Foundation, itself a commercially-affiliated DAF foundation.

In the United States, there has been some concern about commercially-affiliated DAF foundations circulating money between themselves. In this case, the majority of the $8 million netted by CGFC in 2020 from the country’s four of the country’s largest other commercially-affiliated DAF foundations came from a single $7.6 million DAF grant from Private Giving Foundation. Foundation executives told Future of Good that occasionally a donor will decide to switch from one DAF foundation provider to another, triggering a large donation to that foundation.

Other top 2020 DAF donation recipients from some of Canada’s largest commercially-affiliated DAF foundations were: Lloyd & Jay foundation, a Christian charity, Redeemer University, a private Christian university, the University of Calgary, and the BC Cancer Foundation.

The recipients of the largest volume of DAF grants from the country’s five largest secular community foundations were: the Alberta Children’s Hospital Foundation, the St. Michael’s Hospital Foundation, and three private foundations: Toronto-based Externalitator Foundation, Banff-based Bowstrings Heritage Foundation, and Toronto-based Vohra Miller Foundation.

Foundation staff told Future of Good that donors who intend to establish a private foundation will sometimes first establish a DAF. This allows them to receive the full value of the tax receipt for their donation in a year their income is greater, while giving them time to get charitable status for their private foundation. Once the private foundation is established, the donor will then transfer all or most of the money from their DAF to the foundation.

Size wise: Bigger support for bigger charities

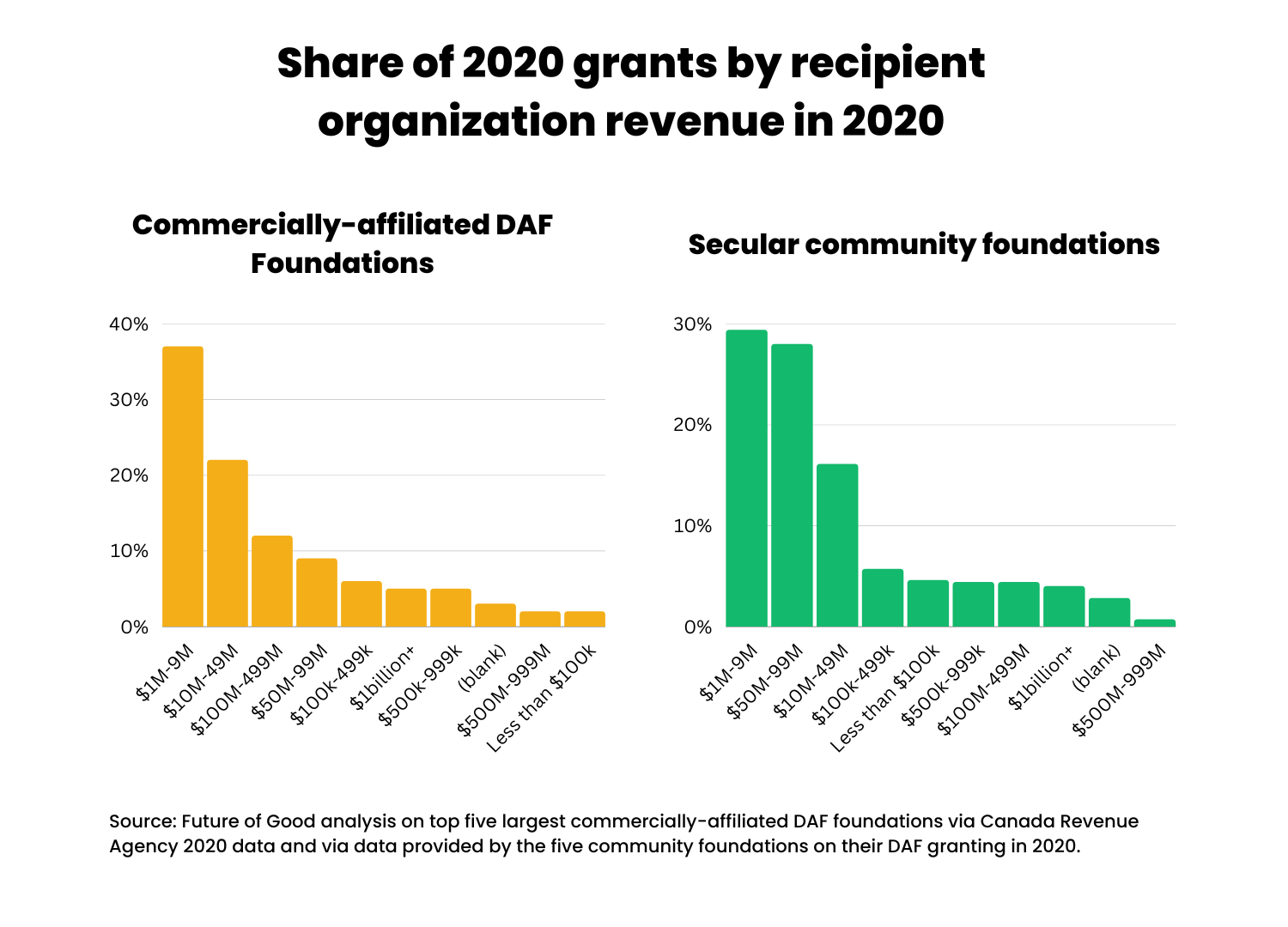

In 2020, the country’s largest DAF foundations provided more support for mid-size and large charities than their smaller peers, when analyzed by both the number of staff of recipient charities and the revenue of recipient charities.

In 2020, 90 per cent of Canada’s 85,000-odd charities reported employing ten or fewer staff, according to Canada Revenue Agency data. Yet these organizations netted just 42 per cent of the 2020 grants from the five commercially-affiliated DAF foundations ($106 million) and just 33 per cent of the 2020 DAF grants from Canada’s five largest secular community foundations ($41 million).

From a revenue standpoint, Canada’s largest charities also received a disproportionate share of support from the country’s largest DAF foundations.

In 2020, just 1 per cent of Canadian charities had revenue of over $50 million, according to CRA data. In that year, however, 27 per cent of the grants from the five commercially-affiliated DAF foundation went to these organizations ($68 million) and 37 per cent of the 2020 DAF grants from the country’s five largest secular community foundations went to these charities, too ($45 million).

Geographic distribution of grants

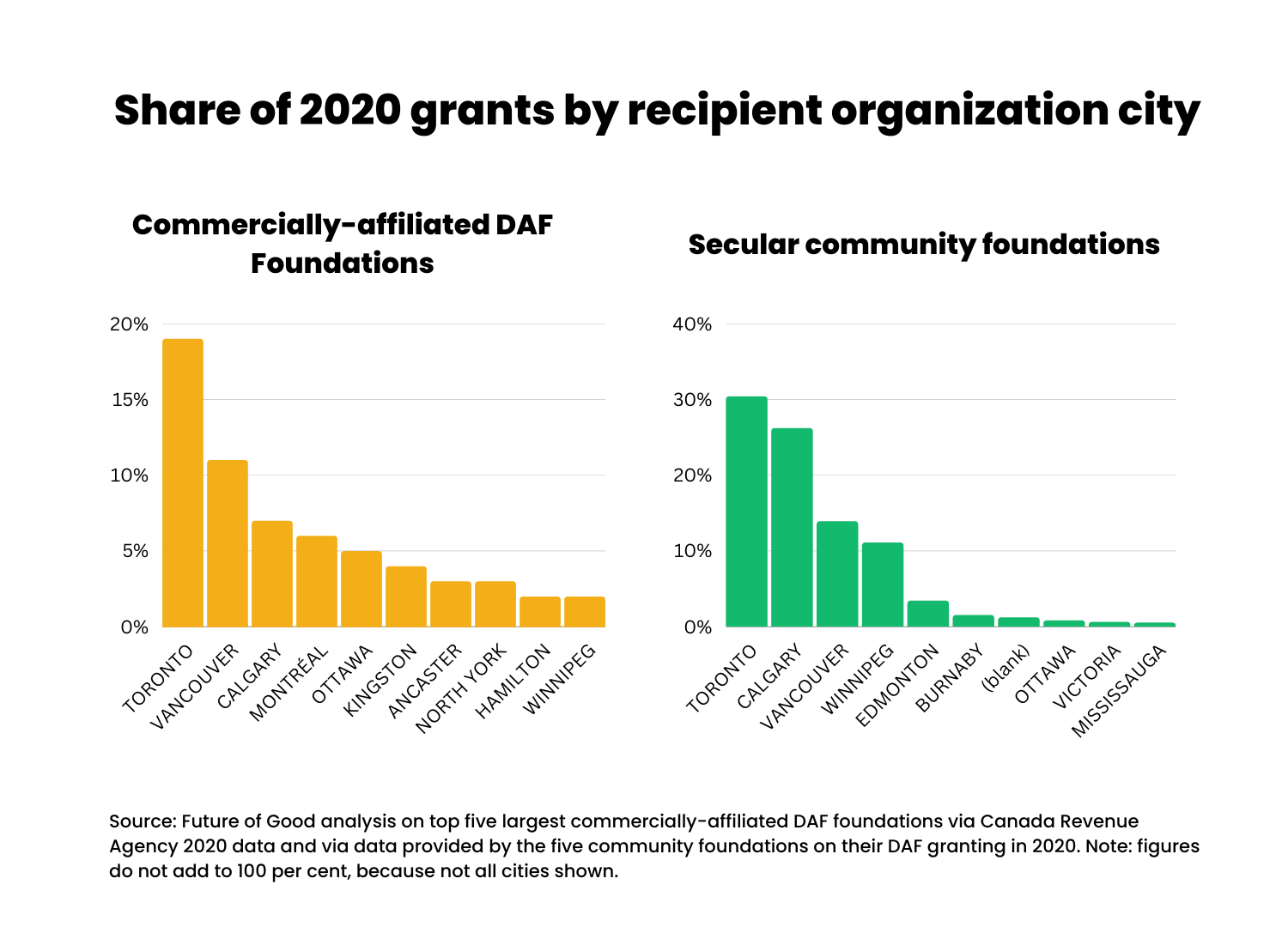

Between the two types of institutions, the geographic distribution of 2020 DAF grants is the spot where the country’s largest community and commercially-affiliated DAF foundations diverged the most.

Eighty-five per cent of 2020 DAF grants from the country’s five largest secular community foundations flowed to charities operating in the five cities where those foundations are based. By contrast, while charities in Toronto, Vancouver and Calgary were the top three recipients of grants from the commercially-affiliated DAF foundations in 2020, charities in Winnipeg and Edmonton ranked 10th and 13th respectively by total share of grants.

Social impact focus of grants: Focus on education, poverty reduction, health

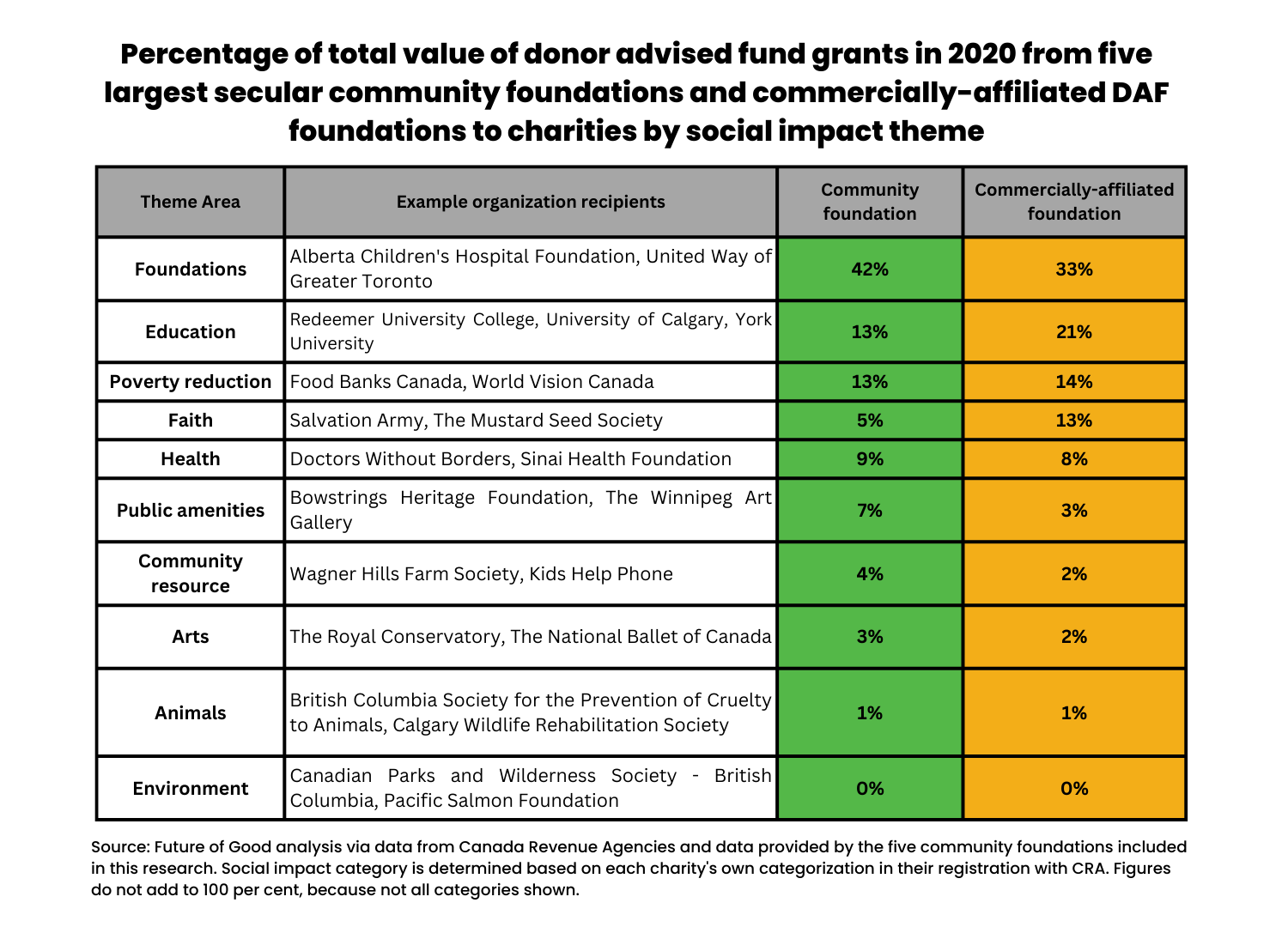

In 2020, there was considerable commonality on the social impact focus of the charities that received the most DAF grants from the country’s five largest secular community foundations and commercially-affiliated DAF foundations, with one exception.

At both types of institutions, the largest share of 2020 grants flowed to foundations and to charities focused on education, poverty reduction and health — causes that tend to be favored by Canadians at large.

The five commercially-affiliated DAF foundations, however, sent a larger share of donations to faith-focused charities than the country’s five largest secular community foundations in 2020 (13 per cent and $35 million, relative to 5 per cent and $6 million).

Among both types of DAF foundations, arts-focused charities received 3 per cent of all donations or less and environment-focused charities received less than 1 per cent.

Type of organization supported: Foundations net big share of grants

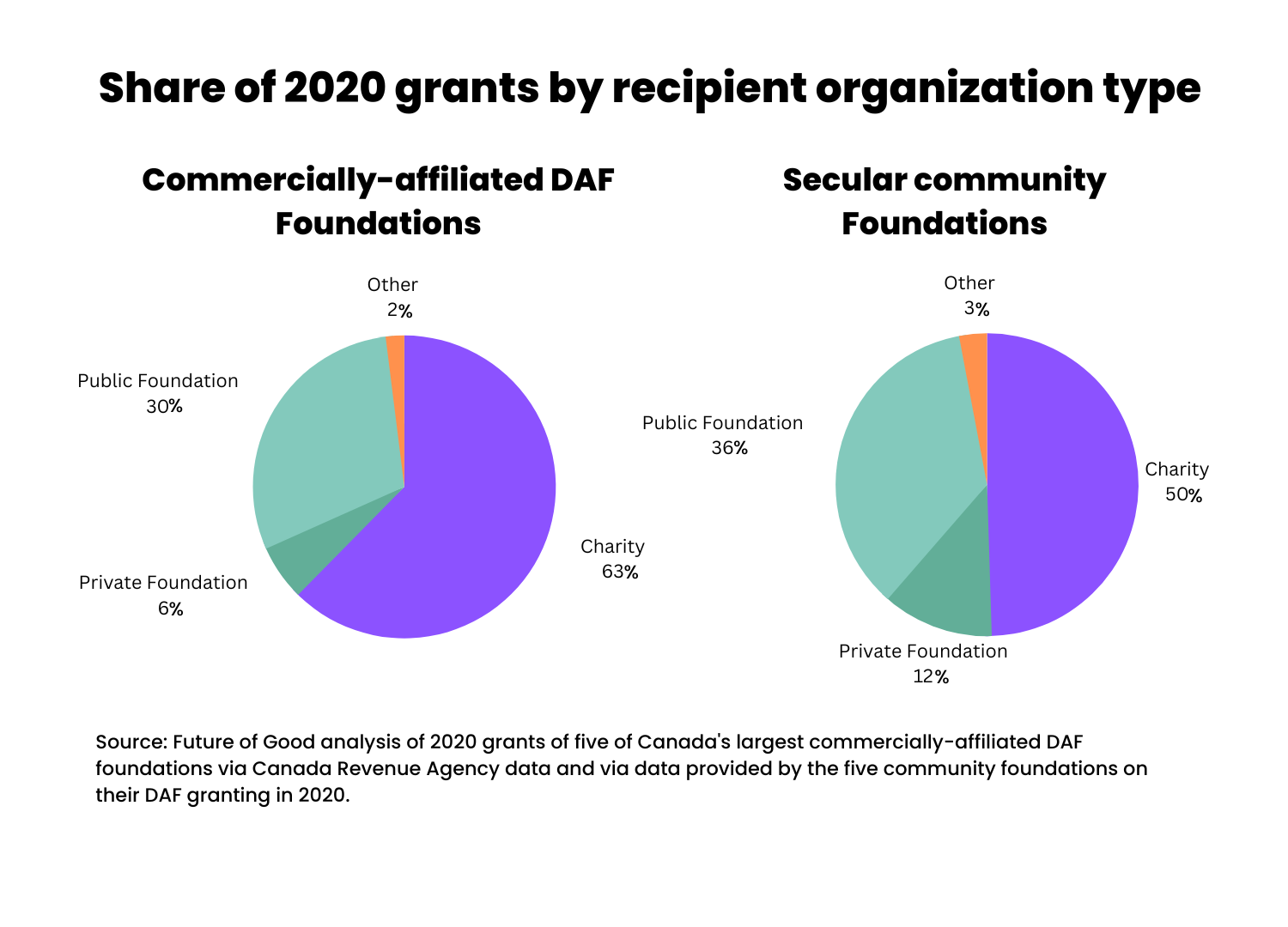

In 2020, the country’s largest DAF foundations provided a disproportionately large share of grants to public and private foundations, compared to other charities.

In 2020, 7 per cent of registered charities in Canada were private foundations (6,017) and 6 per cent were public foundations (4,888), according to CRA data.

Yet, in 2020, 50 per cent of all DAF grants from the five largest secular community foundations flowed to other public or private foundations ($58 million), and 36 per cent of grants from the five commercially-affiliated DAF foundations flowed to public and private foundations, too ($91 million).

–

Methodology: For this story, we compared the 2020 grants from the five largest secular community foundations and the five largest commercially-affiliated DAF foundations as of 2021, excluding CHIMP: Charitable Impact Foundation. To do this analysis we asked the five largest secular community foundations to provide us with a list of their DAF grants from 2020, and we asked CRA to provide us with the same list for the five commercially-affiliated DAF foundations. From CRA, we also retrieved the list of all registered Canadian charities in 2020, including the charity’s address, number of full-time staff, revenue, social impact category and sub-category. We then merged the foundation grant datasets with the charity dataset, and analyzed by: recipient charity organization type, geography, size, and social impact area. Charity organization type was classified by CRA’s designations: public foundations, private foundations and charities. Social impact area was classified by charity “type” as per charitable registration with CRA. Several category types were combined to create broad categories (e.g. the education category includes several CRA categories, including: Teaching institutions, support of schools and education, foundations advancing education and education organizations not elsewhere categorized). Percentages do not add to 100 as 2-3 per cent of grants could not be included in the dataset as the recipient organizations did not have charitable numbers (e.g. grants to American Universities, First Nations without charitable status, or to the United Nations). All percentages are rounded to the nearest whole number. Data does not capture instances where money flowed through a charity to a non-qualified donee.