Manitoba launches new real estate investment trust, but for affordable housing only

Why It Matters

Housing in Canada has become more precarious over the past several years, and governments are looking for new ways to help make housing affordable without crashing the entire economy.

The government of Manitoba announced Tuesday a $10 million grant to increase the supply of affordable housing using an unlikely vehicle: a real estate investment trust.

“Today marks another significant step forward in our collective efforts to end chronic homelessness,” said Manitoba Premier Wab Kinew, in a press release. “We’re proud to partner with the big-hearted business community to put people on a path to home ownership.”

Real estate investment trusts (REITs) are companies that purchase and operate real estate. First established in Canada in the 1990s, REITs were created to enable middle-class investors to invest in commercial real estate.

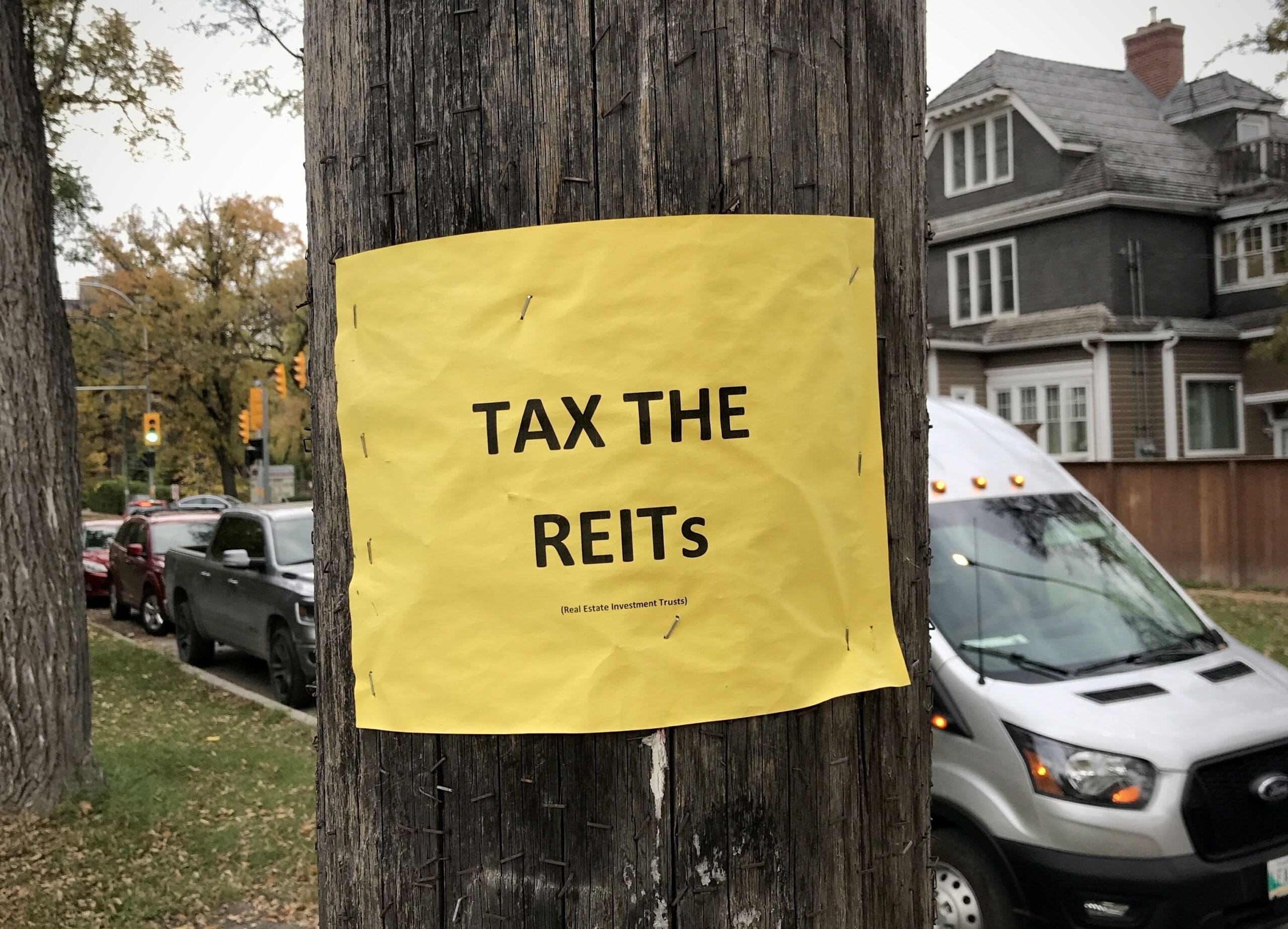

But in recent years, REITs have become a villain among housing advocates—accused of purchasing vast swaths of affordable housing and using apartment turnovers and renovictions to boost investor profits, decreasing affordability.

The province’s new REIT has the opposite goal.

Stewarded by the Business Council of Manitoba, the REIT will convert and renovate existing buildings and build new units, offering below-market rent, according to the release.

The $10 million will fund the REIT’s start-up costs. Subsequently, the Business Council of Canada is expected to solicit investment from private, public, and non-profit sources.

The REIT is expected to acquire or construct at least three new housing projects in the next year.

REITs using apartment turnovers to boost rents: Study

This initiative follows a report published in 2023 by SHARE, a non-profit shareholder advocacy organization. The report analyzed data from six of Canada’s largest REITs and found none disclosed enough information about their practices to allow investors to make informed decisions.

The limited information that was available from Canada’s largest residential REITs suggested that REITs are using apartment turnovers and renovations to boost rents, decreasing affordability for Canadian renters and potentially causing “adverse human rights impacts.”

New tenants saw an average rent increase of 13 per cent over previous tenants at properties owned by the four REITS that provided affordability data in 2022; Canadian Apartment Properties Real Estate Investment Trust had the highest increase at 14.5 per cent.

The report also found tenants who rented newly renovated suites faced much higher rents than previous tenants.

Post-renovation rents were 25 to 29 per cent higher than pre-renovation rents at Apartment Real Estate Investment Trust and Killam Apartment Real Estate Investment Trust — the only trusts to publish this data.

Ricardo Tranjan, a senior researcher with the Canadian Centre for Policy Alternatives told Future of Good last year that sky-high housing costs in Canada are not the result of a so-called “housing crisis,” but rather a “fundamentally unjust housing market.”

Investing in REITs is a “no-win” position from an ethical perspective for Canadian foundations because the business model is predicated on buying housing supply that is limited and then increasing rent, he says.

Tranjan, who was not involved in the SHARE report, says studies have found REITs to be more “aggressive” than other types of landlords, including by pursuing above-guideline rent increases.

-With files from Gabe Oatley