“The bet we placed hasn’t panned out the way we hoped”: As Bitcoin surges, will Canadian crypto-philanthropy as well?

Why It Matters

Following Donald Trump’s verbal commitment to the crypto industry last week, the price of several prominent cryptocurrencies has boomed. Crypto-philanthropy can open a non-profit up to a new audience of tech-savvy donors, and can offer opportunities for more transparency with donors in terms of how their funds are used.

Before working at North York Harvest Food Bank in the Greater Toronto Area, Natasha Bowes was part of the staff at Second Harvest, a national charity dedicated to food rescue and redistribution.

Having toyed with the idea of accepting cryptocurrency donations, and then consulted with a legal professional, Second Harvest were advised to instead disburse the value of the cryptocurrency donation through a donor-advised fund.

Today, at North York Harvest – a much smaller team – Bowes and her team had cryptocurrency donations enabled through CanadaHelps, one of the few online giving platforms with this functionality enabled for Canadian charities.

Launched in May 2022, CanadaHelps’ cryptocurrency donation function aimed to help charities reach younger donors by enabling an “easy and low-risk access to this form of payment,” said Nicole Danesi, senior manager of strategic communications at CanadaHelps.

CanadaHelps’ processing partner would convert the funds to Canadian dollars as soon as a donation was made and send them to the charity.

“We knew it was essential to roll this out in a way where charities did not need any knowledge of cryptocurrency, to open their own accounts, or to be willing to take on any potential risk,” Danesi said.

Since launching, CanadaHelps has processed around $153,000 in 79 cryptocurrency donations for 49 different charities, an average of just under $2,000 per donation.

However, after fluctuations in cryptocurrency market prices and changes with its processing partner, CanadaHelps decided to pause the cryptocurrency donation function earlier this year.

Danesi added that there aren’t currently any plans to reactivate it.

Including North York Harvest, many charities that had this type of donation enabled through CanadaHelps still have their crypto-donation pages up and running – from the Calgary Public Library Foundation to the Literacy Coalition of New Brunswick.

Are “stablecoins” stable enough for the charitable sector?

Despite the name, cryptocurrencies are not considered legal tender in Canada. Rather, they are treated as an asset, and those who trade with them need to be aware of specific tax implications, such as capital gains.

Cryptocurrencies rely on blockchain technology, which the Financial Consumer Agency of Canada describes as a means to “store information in a way that makes it more difficult to change or alter. When you buy, exchange, or sell crypto assets, each transaction appears on the blockchain.”

A collective, time-stamped record of transactions is then formed as cryptocurrencies are traded around, which cannot be changed.

The Financial Consumer Agency also distinguishes between two types of cryptocurrencies. Stablecoins’ value is usually referenced alongside a “stable” asset, such as fiat currency or commodities like gold.

On the other hand, some of the most valuable cryptocurrencies, such as Bitcoin and Ether, are not considered stablecoins — yet they have hit record highs since the re-election of Donald Trump in the U.S., who promised a so-called ‘crypto-friendly’ economy should he be elected.

The picture couldn’t be more disparate between the U.S. and Canada.

Crypto-philanthropy platform The Giving Block has processed nearly US$200 million in cryptocurrency donations on behalf of charities since it launched in 2018, said co-founder Pat Duffy.

“In the past 12 months, we’ve also passed the milestone of having the majority of the Forbes Top 100 Nonprofits equipped to accept crypto, with nearly 90 per cent of those orgs not only accepting crypto, but actively fundraising crypto strategically with our team,” he added, referencing a list of U.S. based non-profits.

His observation is that cryptocurrencies are not only the “fastest growing donation method among U.S. donors in particular,” but also that “cryptocurrency is the most tax efficient donation option.”

For U.S. taxpayers, donating cryptocurrency may prove beneficial because it can lower the capital gains tax they would owe if they were to just sell their crypto-assets.

Meanwhile, in Canada, there seems to be “no particular tax advantage of donating cryptocurrency to a Canadian charity,” wrote lawyer Mark Blumberg in 2022.

Future of Good contacted the Canadian Revenue Agency to determine whether this guidance had changed since. A spokesperson clarified that a cryptocurrency donation is considered to be a non-cash gift, and transferring ownership of the asset must reflect its fair market value.

“The onus is on charities to ensure that the fair market value reflected on official donation receipts is accurate,” the spokesperson added.

“Registered charities and not-for-profit organizations are not subject to income tax. However, individual or corporate donors are subject to income tax on capital gains realized as a result of the donation of property to a registered charity, unless they are otherwise exempt from income inclusion by provisions of the Income Tax Act,” they said.

“As there is no exemption on gains from the disposition of cryptocurrency because of its donation to a registered charity, where a donor realizes a capital gain from such a disposition, the amount would be included in the income” – and hence taxed as such.

In 2019, government relations firm Impact Public Affairs made a pre-budget submission to the federal government to “exempt charitable donations of cryptocurrency from capital gains in the same fashion that it does for traditional securities, such as publicly traded stocks.”

At the time, the firm had launched cryptogiving.ca, to bridge the gap between those wanting to donate cryptocurrencies, and charities wanting to accept them. The site appears to have shut down.

“There was hesitancy [in government] to recognize what the value of cryptocurrency donations could be, should it look like some sort of tacit support for cryptocurrencies writ large,” said Christian von Donat, vice president of government relations and strategy at Impact Public Affairs Canada. Von Donat was part of the original submission made to the federal government.

“You could donate a piece of art, or cash, but if people wanted to donate cryptocurrency, why couldn’t they be treated in the same way?”

Aside from cryptogiving.ca – now defunct – and CanadaHelps, most of the other major donation management platforms that have a cryptocurrency donation functionality for charities operate primarily in the U.S.

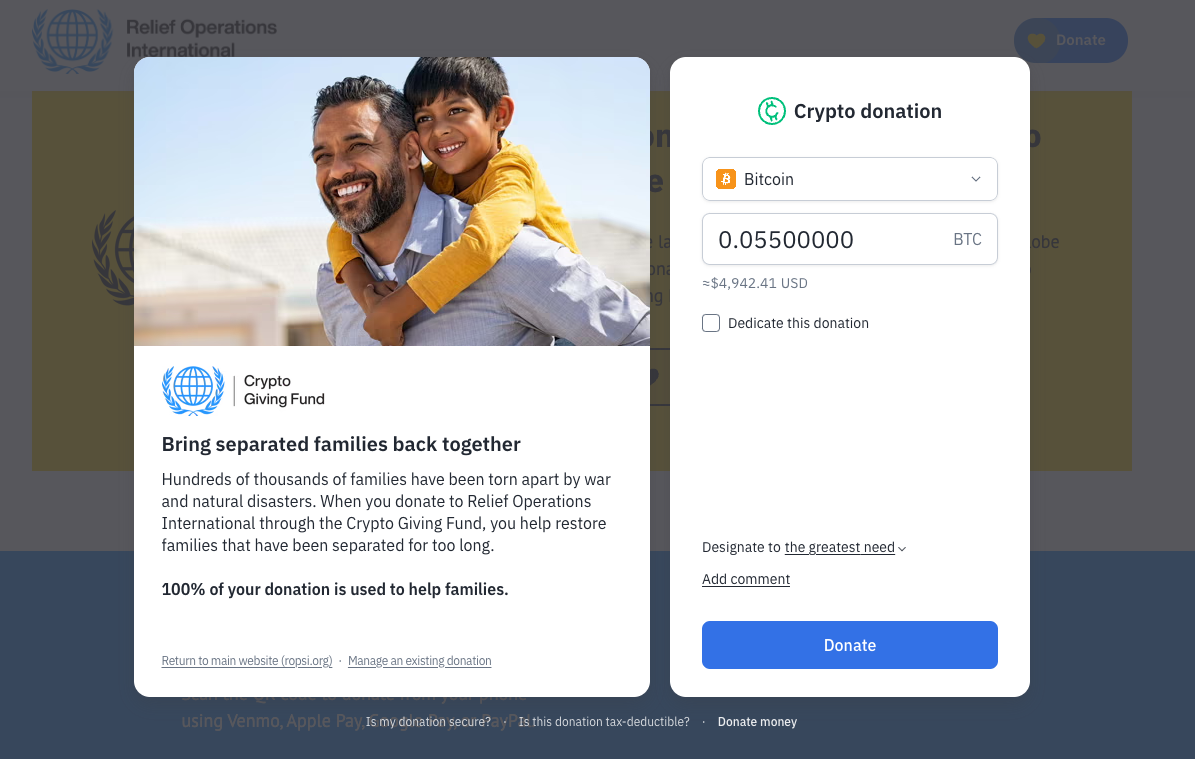

This product mock-up shows how a charity or non-profit could use Fundraise Up to encourage donors to give Bitcoin (Fundraise Up / Supplied)

In order to operate in Canada, they need to meet much more stringent requirements that the Canadian government has enforced, said Salvatore Salpietro, chief community officer at Fundraise Up.

Not only are cryptocurrency regulations a little tighter than the U.S., but operating in Canada requires these online donor management companies to have data servers on Canadian soil to maintain data sovereignty, and to understand the specific CRA tax receipt requirements for Canadian charities.

As one of Fundraise Up’s founding employees, Salpietro said smaller Canadian non-profits, like Pathways to Education and Nanaimo Loaves and Fishes, pulled the company into the Canadian market.

Now, large national non-profits like the Canadian Cancer Society and the Canadian Red Cross are all using the platform.

Fundraise Up’s cryptocurrency donation functionality was originally integrated with two crypto-exchange platforms: Coinbase and Gemini. But maintaining this technology supply chain has been tough.

Coinbase is no longer a partner because of changes in their API integration, which made it difficult for Fundraise Up to justify redeveloping a new means of integrating into their platform.

Gemini, on the other hand, decided to exit the Canadian market altogether, following in the footsteps of Binance.

“The news comes after the Canadian regulator announced a basket of new restrictions on crypto exchanges back in February 2023, enforcing far stricter standards,” according to a Decrypt article, although Gemini does not appear to directly cite this as the reason for their exit. Users have until the end of 2024 to withdraw their funds.

For Salpietro and his non-profit clients, they remain at the whim of these exchange platforms, which are much “closer to government regulation”, he said. They’ll soon be partnering with Stripe instead, who will not only be “rolling out support for stablecoins that will adhere to regulations,” but also be much closer to regulatory changes concerning compliance and anti-money laundering measures.

Despite continuing to invest engineering and partnerships resources in Fundraise Up’s cryptocurrency function, Salpietro has observed the average donation size dropping year over year.

Thus far, in 2024, the average donation size in crypto is US$878. In 2023, the average donation amount was nearly double, at US$1500.

“I would say that the bet we placed on crypto has not panned out the way that we hoped. And I don’t think it has for the non-profits either,” Salpietro said.

“We process millions of donations per year as a platform and crypto is not as impactful on moving the revenue needle as anybody hoped.”

As cryptocurrencies surge again, will charities see success?

Using cryptocurrencies for donation purposes is just the tip of the iceberg in terms of the possibilities that the technology offers, said Jason Shim, chief digital officer at the Canadian Centre for Nonprofit Digital Resilience and the author of a book on Bitcoin fundraising.

Shim was also pivotal in enabling Pathways to Education to become one of the first Canadian charities to accept Bitcoin gifts.

Larger non-profits are toying with alternative uses of cryptocurrencies as part of their innovation work. For example, Mercy Corps Ventures has a Crypto for Good Fund, of which it launched a fourth funding round in November 2024.

Global charity World Vision houses an innovation lab in its Nepalese arm, which, at one point, had two in-house blockchain developers, said Martin Campbell, vice president of strategy and innovation at World Vision Canada.

The Canadian arm of World Vision is set up to accept cryptocurrency donations through The Giving Block, also supported by a “really switched on and understanding [internal] legal team,” Campbell said.

Separately, away from blockchain technologies, it is one of the top-rated charities in terms of transparency and being able to report on where each dollar has gone, Campbell said.

Although this is a great use of blockchain, World Vision Canada uses a much more straightforward process, he added.

“It’s about classic inventory systems and logistic systems, and being able to trace goods and services as they move around the world,” he said.

“It’s just linking up what used to be spreadsheets, and making it into a proper, interconnected data service. And as a result, you can then do some things that are really transformative.”

For smaller organizations, or those considering not using an intermediary to set up their crypto-donation function, Shim emphasizes the need for technically proficient staff and a very secure infrastructure.

Many intermediaries will quickly transfer the value of the cryptocurrency donation into fiat currency, not only so that the charity can access the funds but also so that they are not subject to any impactful price fluctuations.

Other risks of not partnering with a donor management intermediary platform include “improper [or] indirect acceptance” of cryptocurrencies, non-compliant receipting, and accepting either low-liquidity crypto coins or donations from blacklisted or sanctioned people, Duffy added.

In Vancouver, Last Door Recovery Society runs an addiction treatment and recovery centre for those in the community struggling with substance use. Since 2014, the organization has been accepting Bitcoin donations in a bid to reach more tech-savvy donors, said Matthew Kalenuik, director of fund development and projects.

They do so directly, without the need for an intermediary donor management platform.

Bitcoin may have been a small proportion of their overall donations in the last ten years, but it has certainly made a dent: since Last Door launched this option, they have processed around $1 million in Bitcoin donations.

The process to set this up was easy, Kalenuik said. “We created a dedicated Bitcoin cold wallet and integrated it with our website. We didn’t need to partner with an external provider, as Bitcoin transactions can be managed directly.”

Last Door holds its own private keys and spreads the word directly to cryptocurrency enthusiasts through online forums and word-of-mouth within the crypto community. They also work closely with the CRA on compliant tax receipts and accept anonymous donations.

“We’ve observed that Bitcoin donations tend to correlate with overall cryptocurrency market trends. During periods of high crypto prices and media attention, we typically see an uptick in donations,” Kalenuik added.

“I’d suggest that if a charity has the capacity to handle their own wallet and private keys – and enough capacity to handle manual receipting – then it’s a great idea to accept cryptocurrency for donation.”