Advocates like first steps for food insecurity and affordability, but say easier, more permanent solutions needed

Why It Matters

The federal plan offers meaningful short‑term relief for millions of Canadians struggling with rising food costs, but experts warn that without deeper structural reforms, the measures only ease symptoms rather than addressing the root causes of food insecurity.

The federal government has announced a new set of measures aimed at addressing food insecurity, unveiled as Parliament returned for its first day back to work after the holidays.

The announcement included a broad list of initiatives, including a 25 per cent increase to GST payments, beginning in July.

Rebranded as the Canada Grocery and Essentials Benefit, it will increase the quarterly benefits that families and individuals who qualify receive over the next five years.

The government is also providing a one-time payment this year, 50 per cent higher than the regular GST payment.

Prosper Canada, a non-profit focused on making financial assistance accessible to all Canadians, said the move is a step in the right direction.

“We know that food insecurity is fundamentally about income insecurity, and that no single policy can solve it alone. Building on the existing GST/HST credit is a direct and administratively feasible way to improve affordability and reduce food insecurity for people with low incomes,” said Lisa Rae, director of system change at Prosper Canada.

Eligibility for the GST rebate is determined by your income tax return and that implementation will be critical, she said.

“First, access. Because this benefit is delivered through the tax system, automatic federal benefits and hands-on support from community organizations are essential to ensure those who need it most are not left out,” Rae said.

“Second, co-ordination with provinces and territories. Without safeguards against social assistance clawbacks, increases in federal benefits risk being offset, limiting real gains for recipients.”

A qualifying family of four could receive up to $1,890 this year, followed by $1,400 a year for the next four years.

A single person could receive up to $950 this year, followed by $700 annually for the next four years.

The rebate is expected to support more than 12 million Canadians, according to the federal government.

While the announcement offers immediate relief, one expert argues that a more straightforward and more affordable approach would have been to remove GST on food entirely.

“Zero-rating all food – retail and foodservice alike – would be simpler, more transparent and less inflationary than cash transfers,” said Sylvain Charlebois, director of the Agrifood Analytics Lab at Dalhousie University.

“Based on our estimates, each Canadian could save up to $200 a year on food. No applications. No rebanding. No political theatre. Just lower prices at the checkout,” Charlebois said.

Food Security measures

The announcement also included a $20 million boost to the Local Food Infrastructure Fund to ease pressure on food banks.

Food Banks Canada, a national non-profit representing more than 500 local food banks, reported a nearly 40 per cent increase in food insecurity in the last two years.

“For over two years, Food Banks Canada and the food banking network, alongside food insecurity partners and advocates, have been using our collective voice to urge the government to take action on rising affordability pressures and food insecurity through a Groceries and Essential Benefit to support people in the short term as longer-term policies take effect,” the organization said in a statement.

One-in-four people in Canada currently experience food insecurity, it says.

“Food Banks Canada welcomes today’s announcement while looking forward to working with the government to implement this program and other measures announced,” it continued.

Those other measures include the creation of a National Food Security Strategy, which aims to tackle the root causes of food insecurity by strengthening domestic food production and access to affordable food.

The strategy will also introduce unit price labelling and strengthen support for the Competition Bureau as it monitors and enforces competition across food markets and supply chains.

Business support

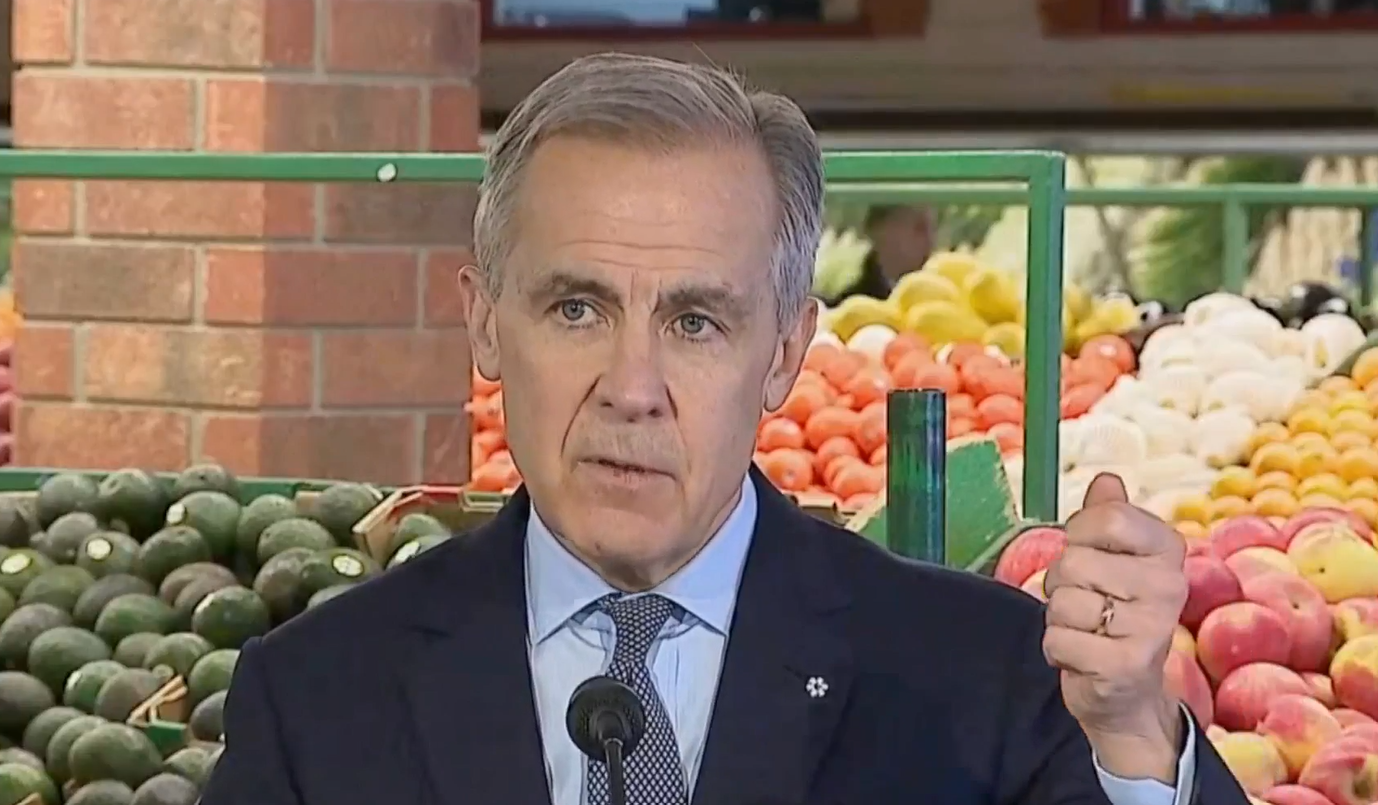

The Carney government also made several announcements to support Canadian businesses.

$500 million from the Strategic Response Fund, designed to support large-scale projects, will be set aside to help businesses cover the costs of supply chain disruptions.

The feds say this measure will prevent those costs from being passed on to Canadians at the checkout line.

“It is a welcome acknowledgement that affordability problems do not begin at the cash register,” said Charlebois.

But he says that amount “barely scratches the surface”, in a country as trade-dependent as Canada.

“Supply chains deserve sustained attention, not episodic funding,” he said.

The feds also announced that a $150 million fund will be created under the Food Security Fund to support small and medium businesses and organizations.

And to support domestic food supply, the government is allowing producers to entirely write off greenhouses acquired on or after Nov. 4, 2025, that become available for use before 2030.

“The new Canada Groceries and Essentials Benefit will provide short-term relief and for many families, that relief will be meaningful,” said Charlebois.

“Without tax reform on food and deeper investment in supply chains, Ottawa risks treating symptoms while leaving the underlying disease untouched.”

The new measures will cost $11.8 billion over the next six years, a federal government spokesperson said.