What non-profits should expect in Canada's 2024 federal budget

Why It Matters

Non-profits tend to be community-based, but a lot of funding flows from the top. The federal budget will point to the government’s top priorities and if those on the front lines of services factor into their long-term outlook.

Non-profits say this year’s federal budget is expected to lean heavily on affordability measures for the average or working-class Canadian.

The Liberal government has already announced several measures and leaked others to the media. They include $2.4 billion for AI transformation, a national food school program, more money for childcare spaces, angst around the carbon tax and affordable housing initiatives, and rental protections and subsidies.

Affordability challenges are at the forefront of most non-profits’ wishes, said Dan Clement, CEO of United Way Centraide Canada.

“Community service organizations are contending with rising costs of program delivery – from food, insurance, materials – while demand for support has only risen,” he said.

“We need a commitment to funding practices that respond to rising costs and invest in building the capacity of community service organizations.”

Imagine Canada, another significant umbrella organization for the non-profit sector, said it’s monitoring changes to funding.

“Predictable core funding, allowing more project-based funding to be used for operating costs, increasing multi-year funding, and increasing funding flexibility,” are all on the agenda, they said.

Emerging issues include possible changes to the Alternative Minimum Tax and revenue, more funding for affordable housing and shelter spaces, and significant funding for supporting immigrants and refugees, they added.

“These recommendations indicate that organizations offering frontline services may be experiencing increased demand.”

The federal government seldom recognizes the increased demand handled by the charitable and non-profit sectors, Clement said.

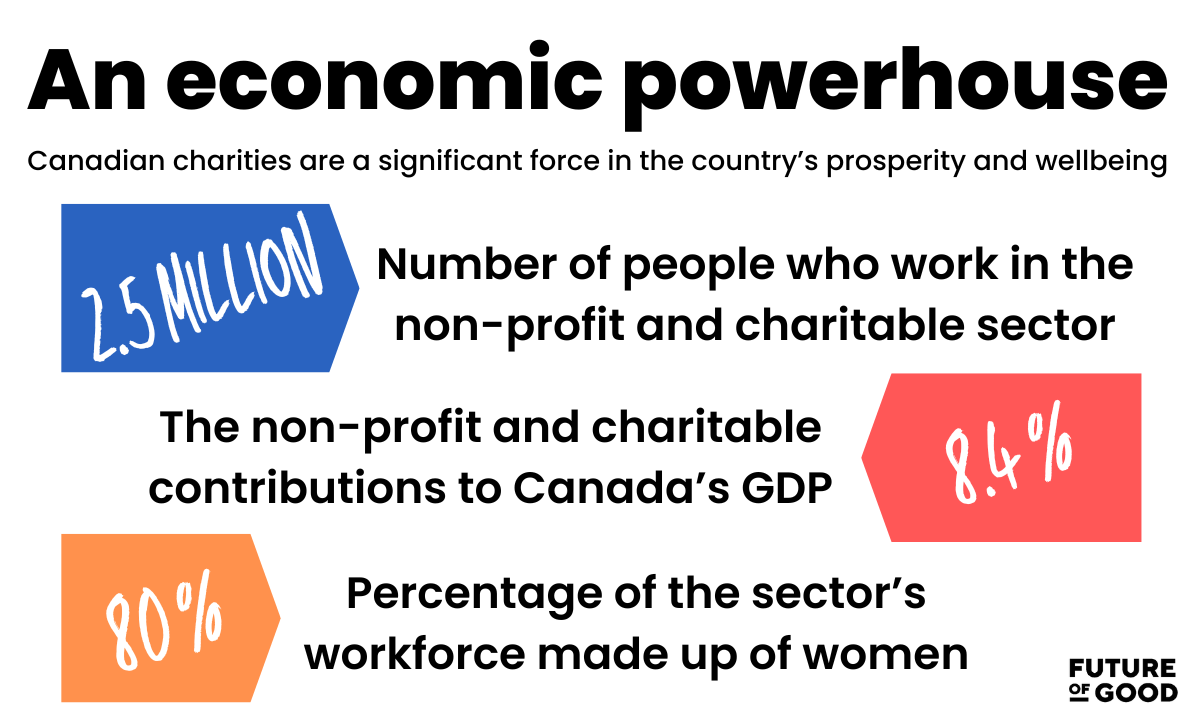

“Budgets are often positioned as investments in our collective prosperity. The public needs to see the sector positioned as an integral force in our shared wellbeing and economic prosperity – a social and economic powerhouse,” he said.

The sector employs 2.5 million people and contributes 8.4 per cent to Canada’s GDP – and the labour force is nearly 80 per cent women, Clement added.

“The Federal Budget … signals what we value and are ready and willing to invest in. My wish is a federal budget that recognizes Canada’s charitable and non-profit sector as essential to the economic and social wellbeing of people and communities and makes a commitment to building a sustainable, resilient, and innovative sector.”

Canadians often don’t think about how much the non-profit sector touches their lives, said Annika Voltan, Executive Director at Impact Organizations of Nova Scotia.

“When compared to other countries, you can see that this sector is upholding a lot of service delivery on behalf of government,” said Voltan.

“There are so many complex social challenges that no one government department is accountable for, and because of the way (often limited) funding does flow to provinces and territories, many communities rely on non-profit support for basic needs.”

When looking at the federal budget, the social purpose world and the population at large should look at what kind of metrics come with the announcement, said Voltan.

“For example, there is a National Food Advisory Committee that is tasked with complex work on food insecurity, but there are not currently any communicated goals, metrics or commitments about what that means,” she said.

Voltan echoed Clement’s comments about wanting to see sustainable funding for non-profits, and recognition from the federal government that the sector is doing critical work on their behalf.

What Future of Good anticipates

Social finance:

Prime Minister Justin Trudeau has mentioned the creation of the Canada Rental Protection Fund, a national affordable housing initiative inspired by the BC Rental Protection, launched in January 2023.

It’s been leaked that the 2024 budget also includes $400 million to accelerate housing construction.

“The devil is in the details, said Jacob Homel, director, Public Affairs at Le Chantier de l’économie sociale.

“Will social economy organizations get a head start? Because most of the way out of the housing crisis will not happen through the private sector.”

Ottawa launched the Social Finance Fund last year, a $750 million initiative, and groups want it to continue, provided it has the promised impact.

“We will be attentive to measures that will have a concrete leverage effect on our common positive impact targets, such as the fight against climate change, the reduction of poverty and social inequalities, and concrete solutions to the issues experienced in indigenous and in regions outside the major centers of Quebec,” said Bernard Ndour, CEO of Fonds Cap Finance, one of the three wholesalers who manage the fund.

Le Chantier de l’Économie Sociale would like “some funding similar to the Investment Readiness Program, which terminated this spring,” said Homel.

“It made a big difference for many Quebec social enterprises. We still have a waiting list for the program.”

Groups are also waiting for money and information about 2022’s “Taxonomy Roadmap Report,” published by the Sustainable Finance Action Council.

“The Liberal government is dragging its feet on … the establishment of criteria to distinguish investments to green polluting companies from those which prolong the status quo,” writes Miville Tremblay, senior fellow at CD Howe Institute.

“This taxonomy is essential for directing capital into projects that will make a real difference.”

Technology and Data:

The government has already announced that it will pump $2.4 billion into the Canadian artificial intelligence ecosystem ahead of the budget. This enormous pot of funding includes dedicated funding for small and medium-sized businesses to access AI, support workers AI might impact, and create a Canadian AI Safety Institute.

So, announcements specific to industries and whether non-profits and community organizations are meaningfully included are high on the priority list.

The federal government also recently cancelled its Canada Digital Adoption Program (CDAP), a $4 billion grant program to help small and medium-sized businesses develop online business and other technology capabilities.

Policy Options reported low uptake, with less than a fifth of the original budget being claimed. They also speculated that the program was “too rigid,” which may have been off-putting to business applicants.

However, funding digital capacity and skills is more urgent than ever. With that in mind, it will be important to watch for more funding announcements for subsidized digital and technology training.

Finally, it’ll be interesting to see if there is an update on connectivity and internet accessibility around the country. The federal government aims to connect 100 per cent of Canadians to high-speed internet by 2030, including the Universal Broadband Fund.

So far, the government reports that more than 90 per cent of households are connected to high-speed internet, but the Yukon, Northwest Territories, Nunavut and Newfoundland & Labrador still lag.

Equity and Diversity:

As antisemitism, Islamophobia, and anti-2SLGBTQ+ hate rise dramatically, social purpose organizations will look to the feds for more robust funding to be able to track trends and craft policies to address growing hate.

Community leaders told Future of Good that funding for services that combat hate is inadequate as incidents continue to rise. Community groups hope for a centralized reporting system and more funding for victim support.

In 2022, the federal government launched its first Action Plan on Combatting Hate, an initiative meant to address hate as it relates to racialized and religious minority communities in Canada and their intersections.

While the anti-racism strategy focuses on the broader systemic level, the Action Plan on Combatting Hate is more narrowly focused on hate incidents, hate crimes and violent extremism.

Last year’s budget included a $160 million investment over three years for the Women’s Program to provide more funding to organizations in Canada that serve women. This program’s goal is to maintain historic funding levels for women’s organizations and equity-serving groups, with a focus on Indigenous women, women with disabilities, members of the 2SLGBTQ+ communities, newcomers, Black, and racialized women.

Funding models:

This year’s budget is expected to provide a hotly anticipated decision about whether the government will proceed with planned changes to the Alternative Minimum Tax affecting charitable donation incentives.

In Budget 2023, the government promised to reduce two tax incentives for charitable donations for wealthy Canadians as part of broader AMT reforms to increase tax fairness.

In response to the planned changes, some wealthy donors contacted charities, saying they would reduce pledged donations unless the government reversed course.

Fearing a decrease in giving, advocacy groups Imagine Canada and the Canadian Association of Gift Planners helped mobilize hundreds of charities to contact the Department of Finance, encouraging scrapping the charity-related reforms.

The government may have taken note of the alarm, choosing to delay the implementation of the planned tax policy tweaks in 2024 as initially promised.

In November’s 2023 Fall Economic Statement, the government said it would proceed with the AMT changes “as modified to consider consultations and deliberations since their release.”

Whether this means the government has decided to move forward or carve out the charity-related AMT changes will likely be settled this week.

Volunteerism:

Megan Conway, Volunteer Canada president and CEO, hopes Budget 2024 will see the federal government invest in a National Volunteer Strategy.

“We’re really hopeful that the federal government recognizes the leadership opportunity that they can play in developing that strategy,” she said. “Because the last one was 50-plus years ago, so we think it’s definitely time.”

“Given the ways in which volunteering really strengthens and supports quality of life — and how challenging the cost of living is right now — volunteers are able to deliver services in ways that support community wellbeing,” said Conway.

Last week, Freeland announced that her government intends to double the Volunteer Firefighters Tax Credit and the Search and Rescue Volunteers Tax Credit from $3,000 to $6,000.

“Volunteer firefighters and search and rescue volunteers play a critical role in protecting Canadians,” reads a federal government press release.

“Every year, thousands of Canadians volunteer their time and sacrifice their safety to keep their neighbours safe.”

Global Aid:

Budget cuts are expected for Canada’s international assistance funds.

As part of the government’s commitment to reducing spending, Global Affairs Canada, the department leading the country’s international humanitarian and development assistance programs, has announced plans to cut its budget by $118 million for 2024-25. The following year, the cuts are expected to increase to $179 million. For 2026-27 and beyond, the reductions will deepen to $243 annually.

We already know Ottawa plans to scale back the International Assistance Innovation Program and Sovereign Loans Program, end funding for the Middle East Strategy in 2025, reduce funding for the Peace and Stabilization Operations Program and the Canadian Police Deployment, as well as reduce the department’s top cadre and travel expenses.

If the department’s budget is reduced, the move will contrast to previous years when Canada’s international assistance reached record levels.

In 2022-23, Canada witnessed an unprecedented surge in global aid, with total international assistance skyrocketing by 91 per cent to reach $16.049 billion. This increase was primarily driven by the Department of Finance of Canada (DFC), which facilitated a significant portion of aid through loans amounting to $4.85 billion to support Ukraine’s economy. GAC also experienced a substantial budget boost of 17.2 per cent, reaching $6.978 billion.

The increase made the year the most significant on record for GAC, surpassing even the levels of 2020-21. Health remained a top priority, with GAC allocating $2.2 billion to the sector. However, the aid extended to Ukraine from the DFC exceeded this amount.

In the previous year, 2021-22, Canada’s total international assistance had experienced a slight decline of 4 per cent, settling at $8.396 billion. GAC’s budget witnessed a more significant decrease, dropping by 14.6 per cent to $5.95 billion. Global health initiatives received the most funding, amounting to $1.82 billion.

The initial surge occurred in 2020-21 when Canada’s total international assistance increased by 27.2 per cent from the previous year to $8.429 billion. GAC played a pivotal role by distributing $6.97 billion of this aid. Global health was the primary recipient, securing $2.2 billion in funding.

-With files from Diane Berard, Sharlene Gandhi, Jahanzeb Hussain, Gabe Oatley and Shannon VanRaes.